⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

Consolidation

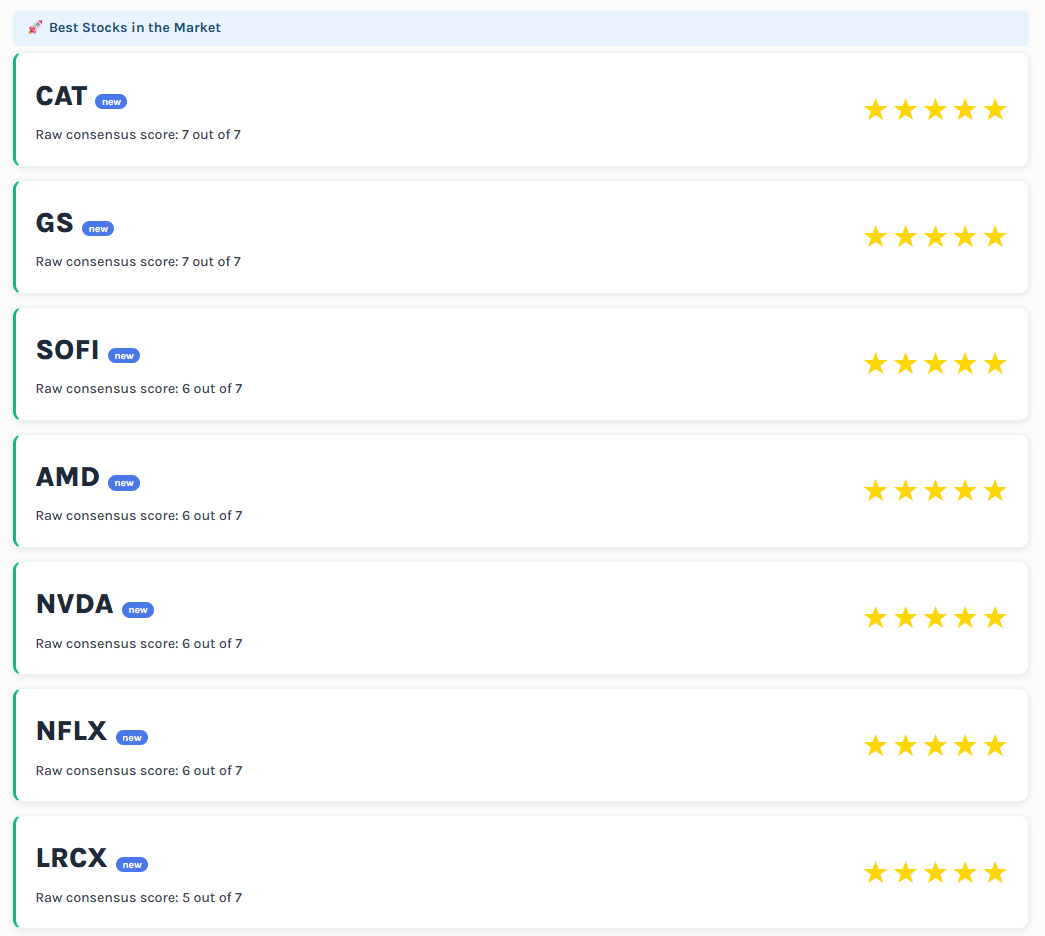

IBIT Delta Tilt and Gamma Exposure

IBIT has been consolidating a bit on the higher timer frame chart as the EMAs catch up with price. We are still waiting for additional variables to line up for a potential long but this EFT is one to watch for sure.

Potential support: $65 area

Raw Consensus Score: 1 out of 7 (Neutral momentum) (Momentum Stars)

Want the Levels to watch today? Join our premium channel

Today’s Top Idea

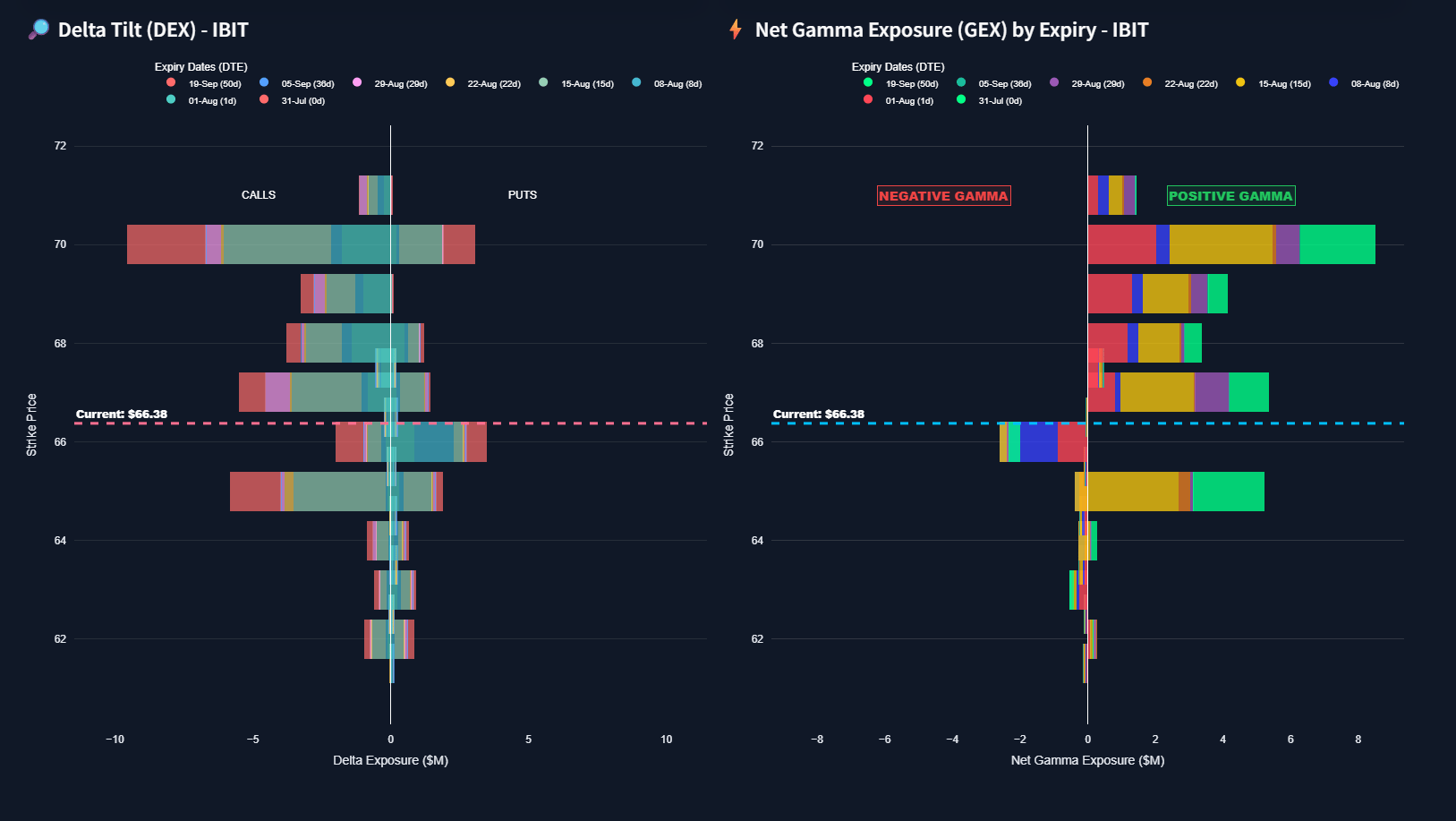

ABBV Delta Tilt and Gamma Exposure

ABBV reported decent earnings today before the bell today. We can see the $200 area already acting as some resistance so we will be patient and wait for bull backs.

Summary table of selected metrics (Q2 2025):

Metric | Q2 2025 Value | YoY Change |

|---|---|---|

Net Revenues | $15.42B | +6.6% |

Net Earnings (GAAP) | $938M | -32.5% |

Adjusted Diluted EPS | $2.97 | +12.1% |

Immunology Revenue | $7.63B | +9.5% |

Skyrizi Revenue | $4.42B | +62.2% |

Rinvoq Revenue | $2.03B | +41.8% |

Operating Margin (GAAP/Adj.) | 31.7% / 44.3% | N/A |

Price area we like for a potential long entry: $195 - $190 area

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Want the Levels to watch today? Join our premium channel

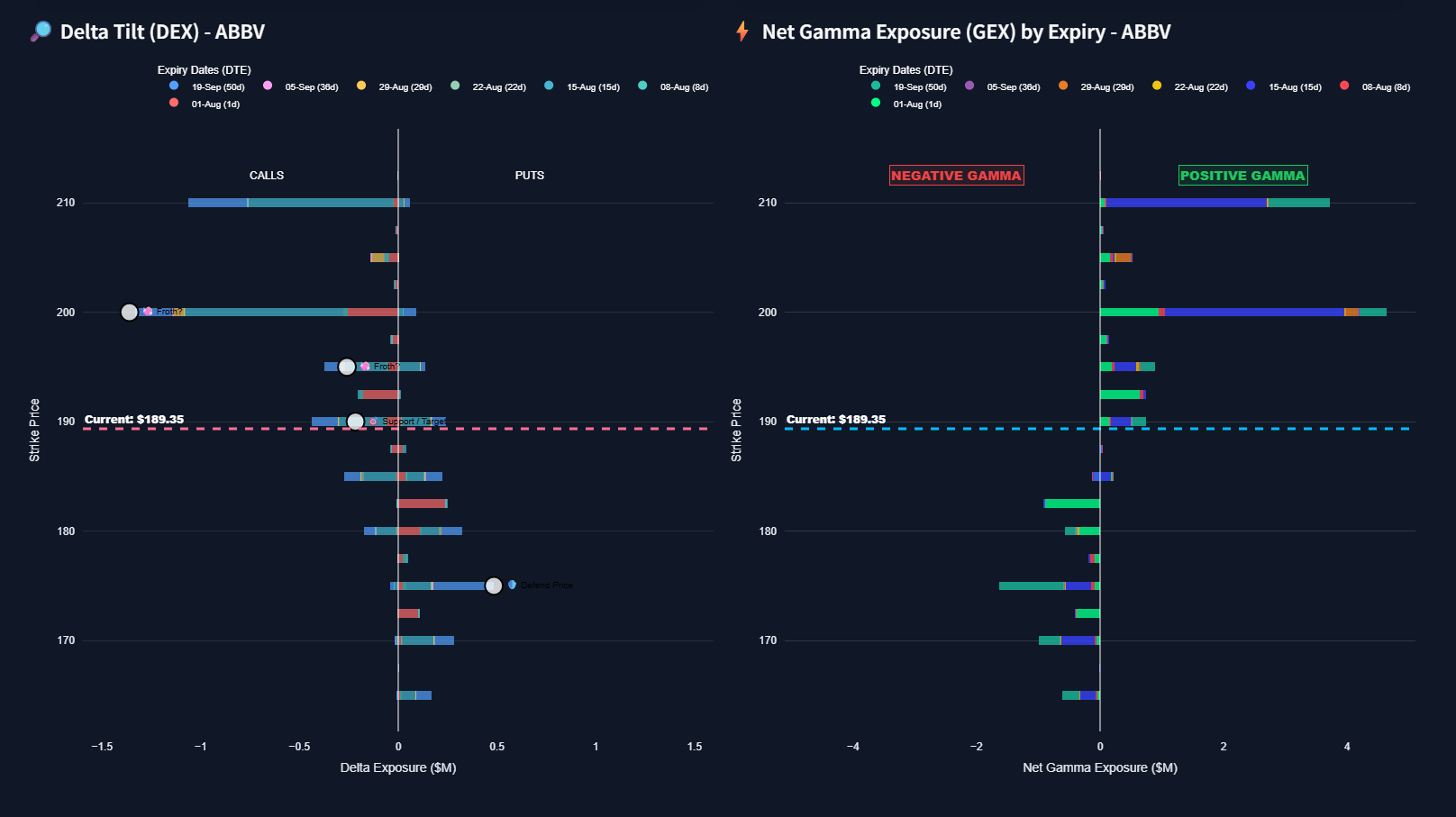

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️