⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $JNJ ( ▼ 1.79% ) . A 4 hour Squeeze set-up with momentum starting to build up.

Scroll down to learn more about today’s top idea.

Consolidation

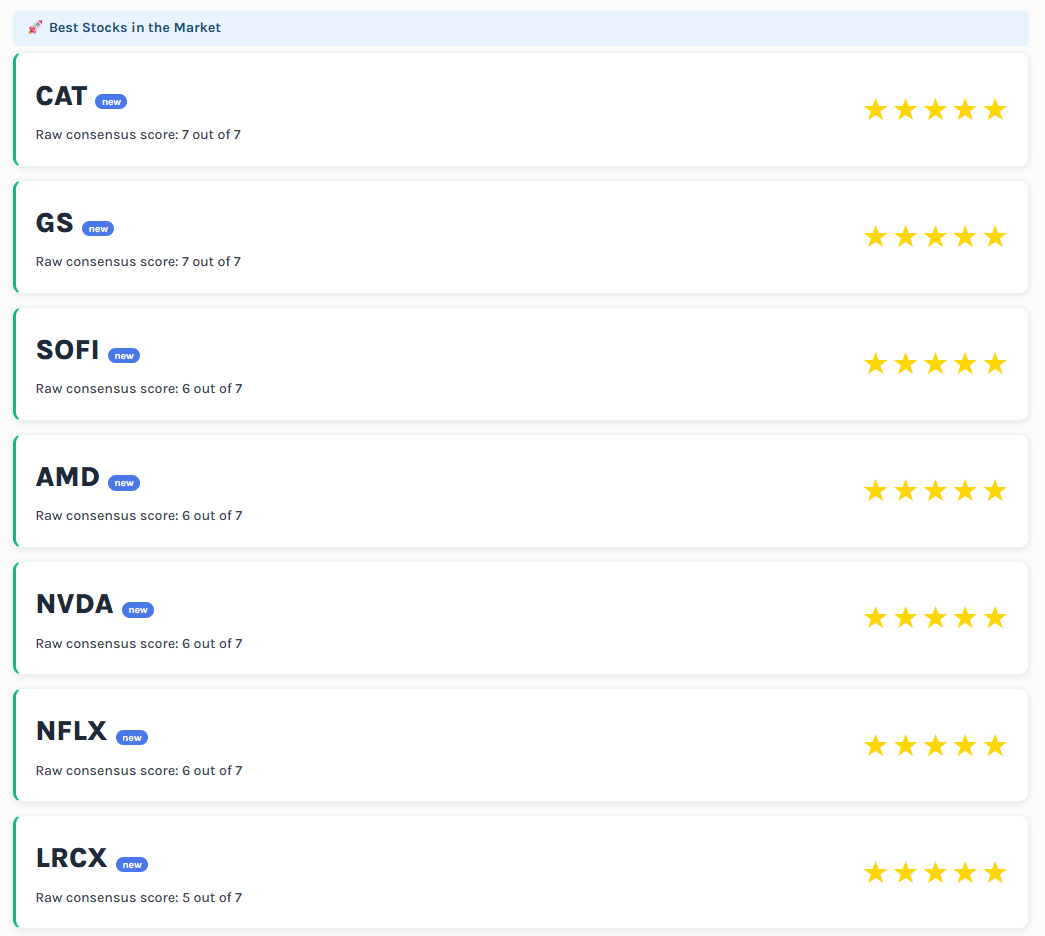

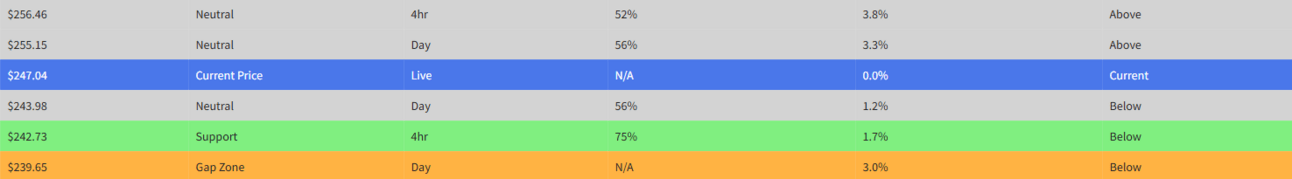

HIMS Delta Tilt and Gamma Exposure

Hims & Hers Health, Inc. ($HIMS), was a name we liked, plunged after news of Novo Nordisk ending their partnership.

The stock has cooled off a bit, and we might see some consolidation now. The 4-hour chart is at an interesting level. We'll be watching it closely.

Raw Consensus Score: -1 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

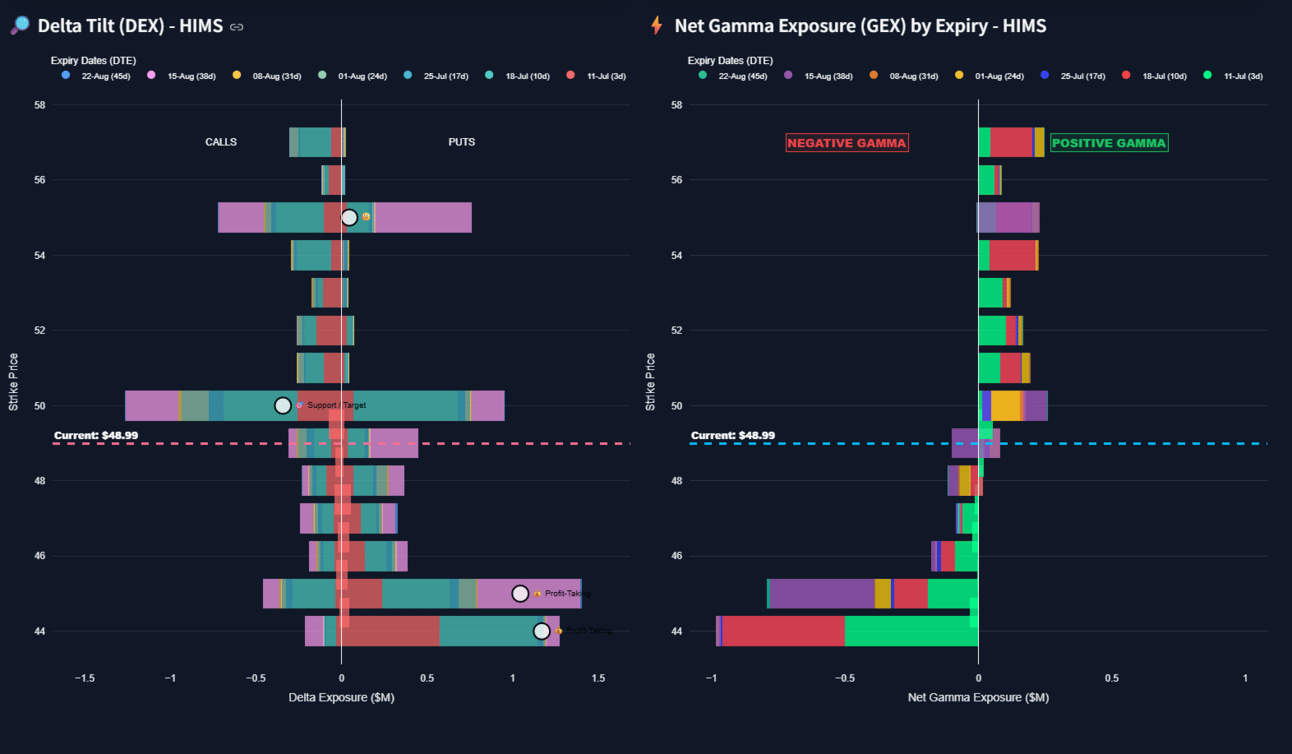

HON Delta Tilt and Gamma Exposure

Honeywell ($HON) continues to push higher, and we like its strength. We're watching the $240 area as a potential support level. There's a possibility we could see a blow-off top around the $250 level.

A blow-off top is a chart pattern where a stock sees a rapid, steep increase in price and volume, followed by an equally sharp decline. It often signals the end of an uptrend. We'll be monitoring the price action closely around $250 for signs of this.

Raw Consensus Score: 2 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

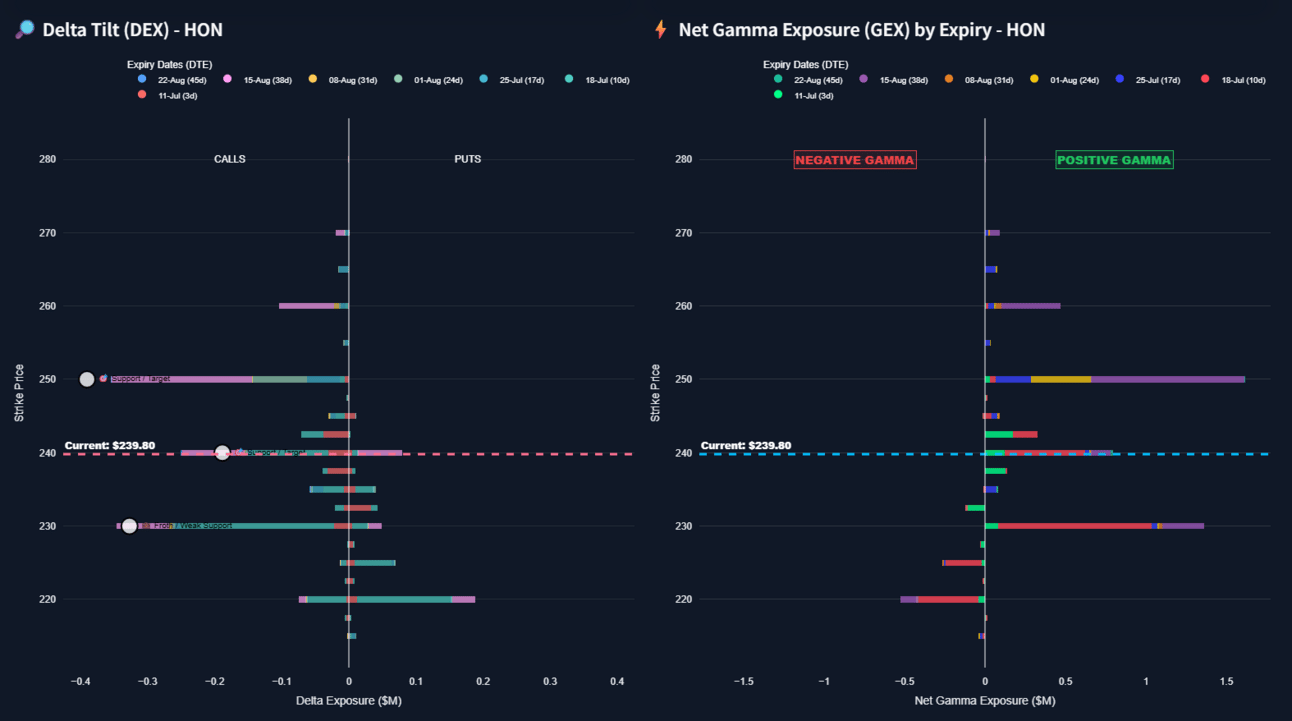

GE Delta Tilt and Gamma Exposure

We've traded General Electric ($GE) on momentum in the past, and it looks like it's setting up again on the daily chart. We still like this name. Levels if interest $250 to hold then looking for a $260 target area.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

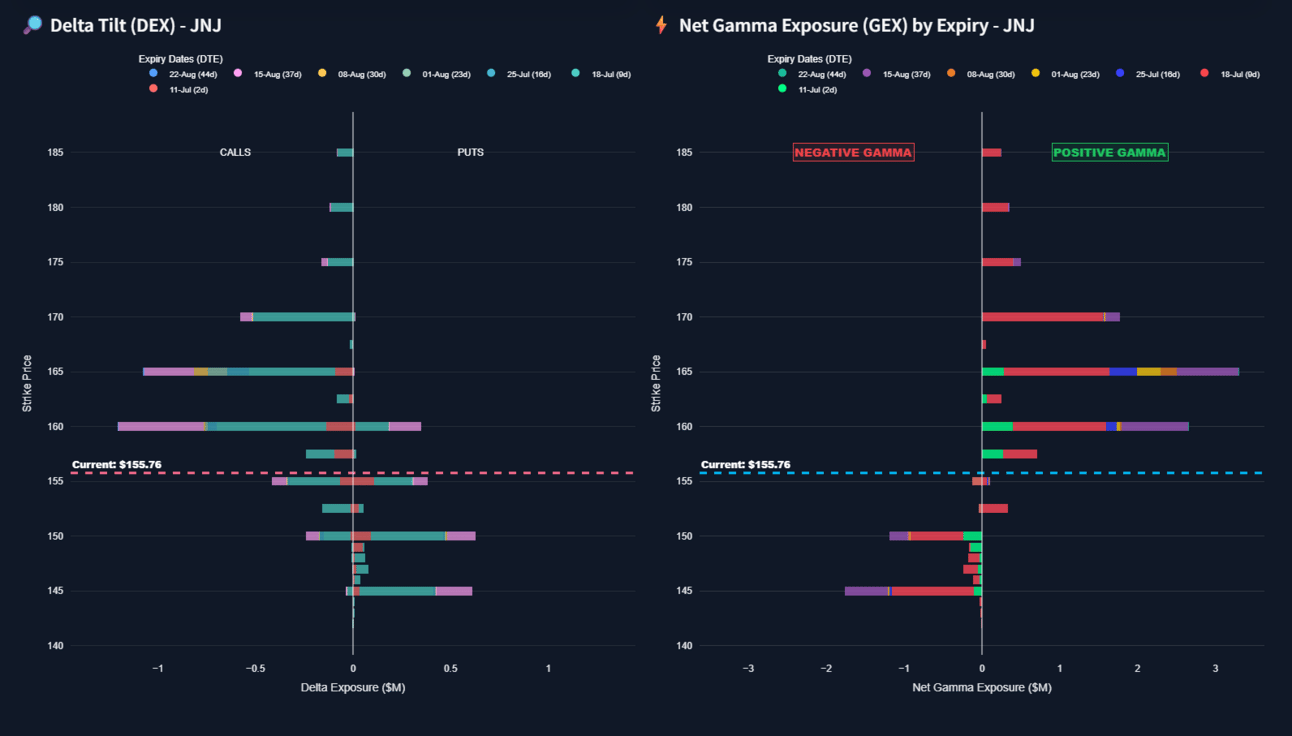

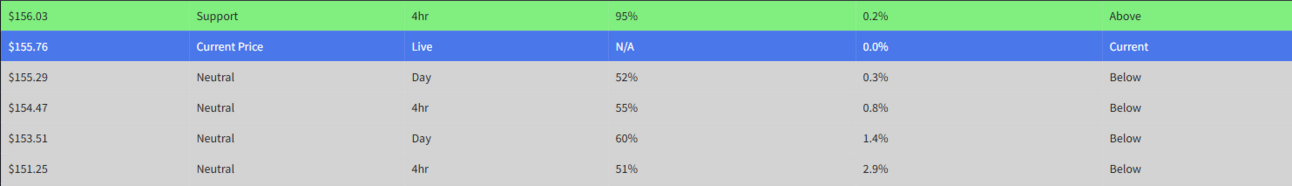

JNJ Delta Tilt and Gamma Exposure

JNJ appears to have a decent higher timeframe set-up (4 hour), we like the squeeze and also the presence of momentum on the higher timeframes. Watching the $155 to act as support and target at $160 area

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

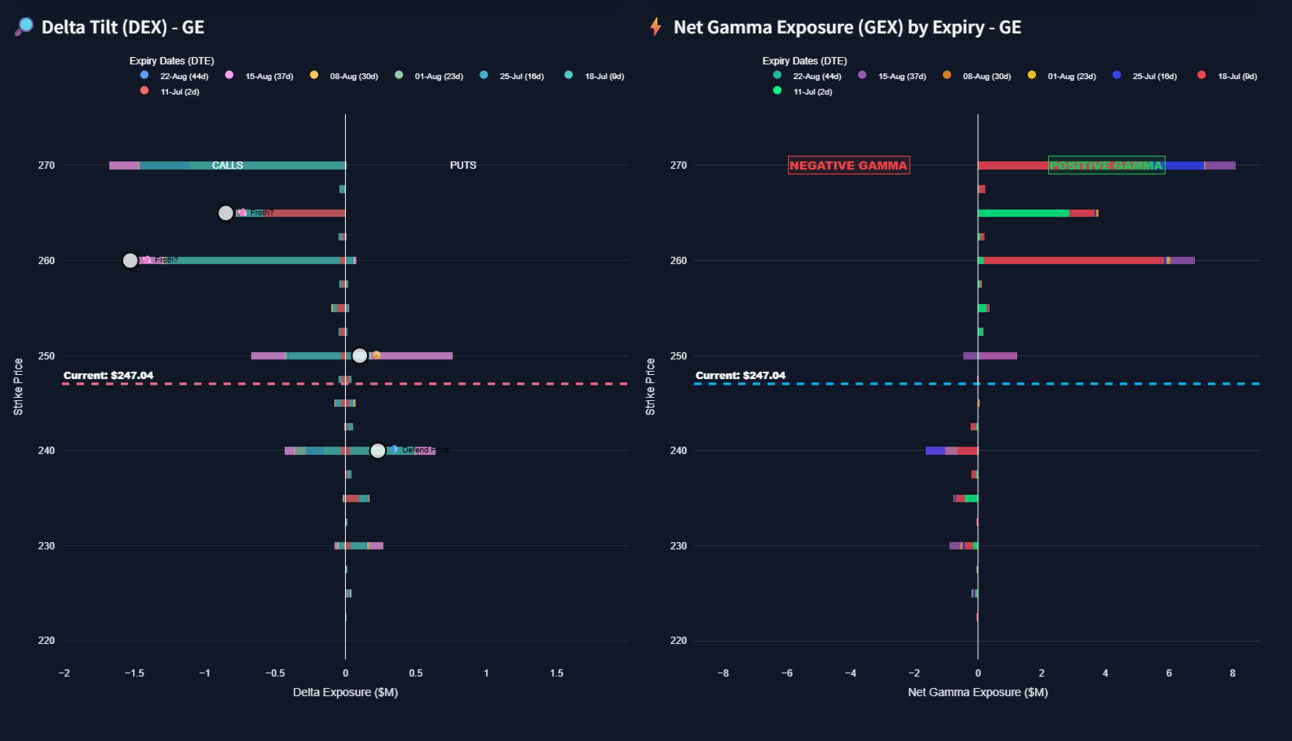

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️