⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $SHOP ( ▲ 1.94% ) . we like the delta and gamma chart pointing the way to $120

Scroll down to learn more about today’s top idea.

Momentum Up

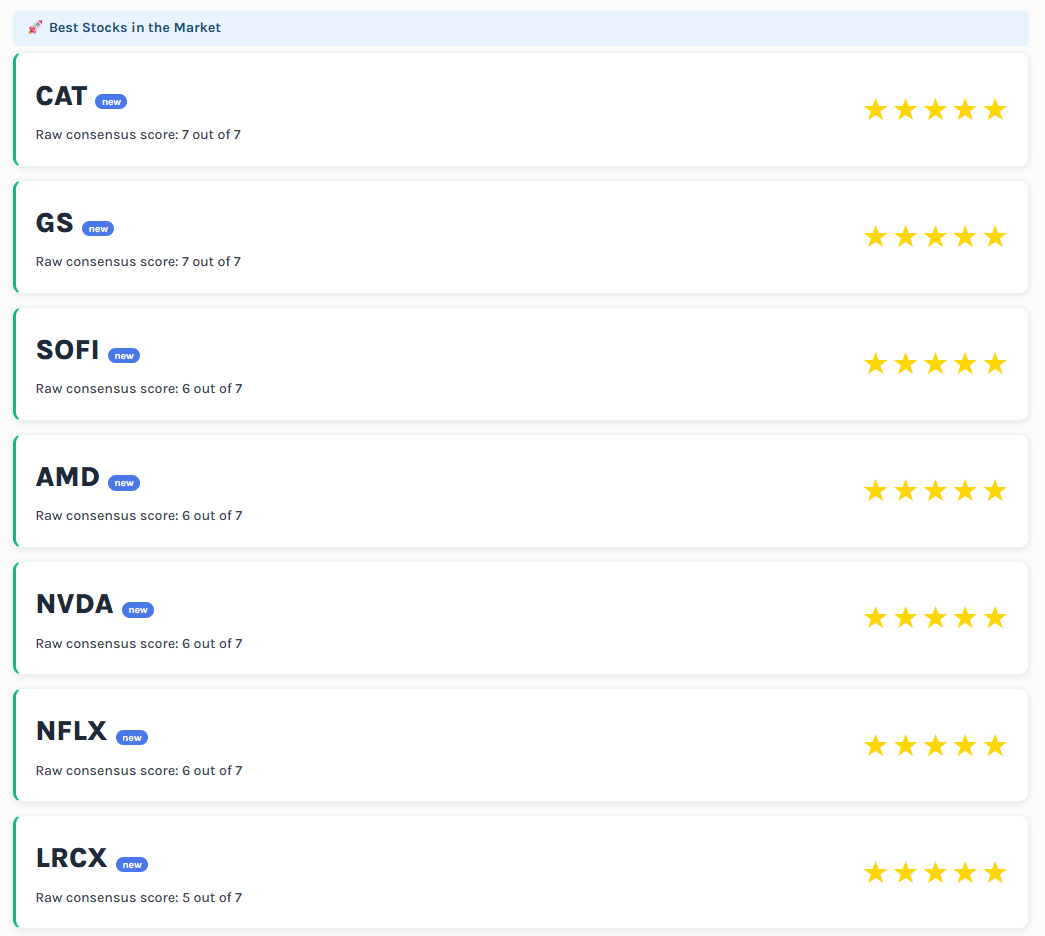

HON Delta Tilt and Gamma Exposure

Honeywell ($HON) was a name we highlighted weeks ago. We sold around $230, but it continued its move to $240.

The daily chart still shows impressive momentum, but we're watching to see if it's running out of steam. We don't short names just because they seem "too high" or "too extended." We follow the price action and use our momentum indicators to guide us. $HON remains on our radar.

Raw Consensus Score: 3 out of 7 (Neutral momentum) (Momentum Stars)

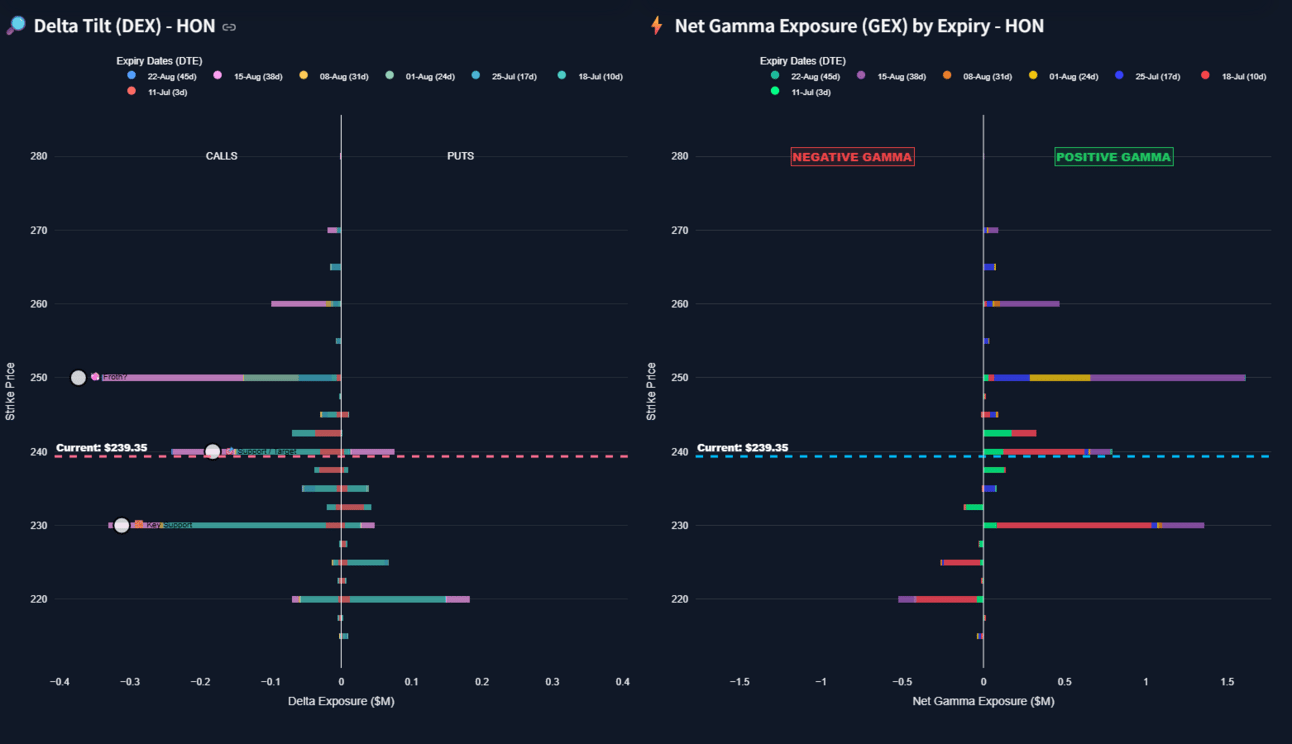

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

HOOD Delta Tilt and Gamma Exposure

Robinhood ($HOOD) continues its upward push. We're watching it closely today.

The $95 area is a key level to watch due to significant dealer activity there. If it breaks, we could see further upward movement.

However, we think a slight pullback might occur soon, as momentum on the 4-hour timeframe seems to have lessened.

Raw Consensus Score: 4 out of 7 (Very bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

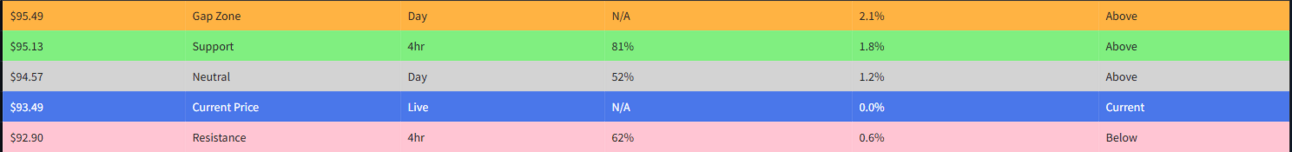

IBM Delta Tilt and Gamma Exposure

We've liked IBM on its way up, but it seems to be losing some upside momentum on the daily chart. We're watching the $300 area for resistance, which could lead to a cool-off period. However, it might still push higher in the short term. In our opinion, this name still looks bullish.

Raw Consensus Score: 2 out of 7 (Neutral momentum) (Momentum Stars)

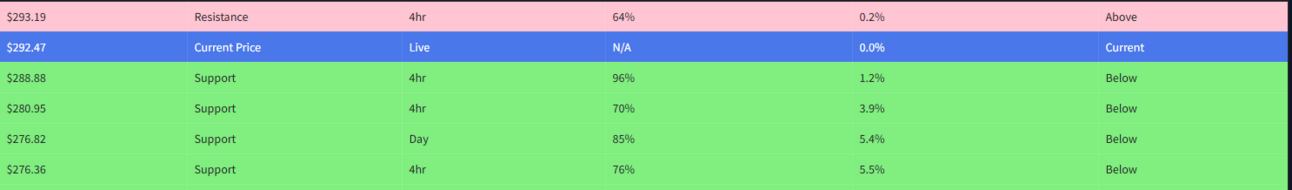

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

SHOP Delta Tilt and Gamma Exposure

Shopify ($SHOP) is our top idea for today. We like the $120 target area.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

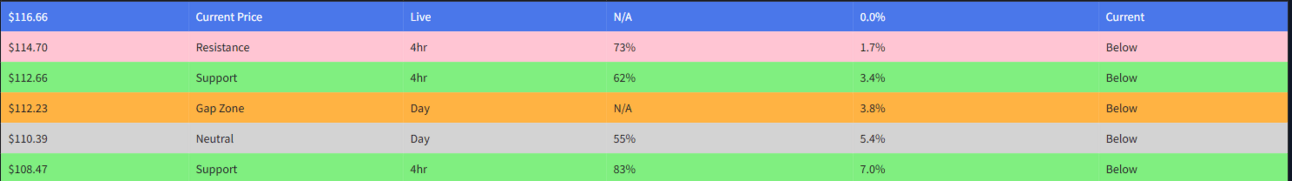

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

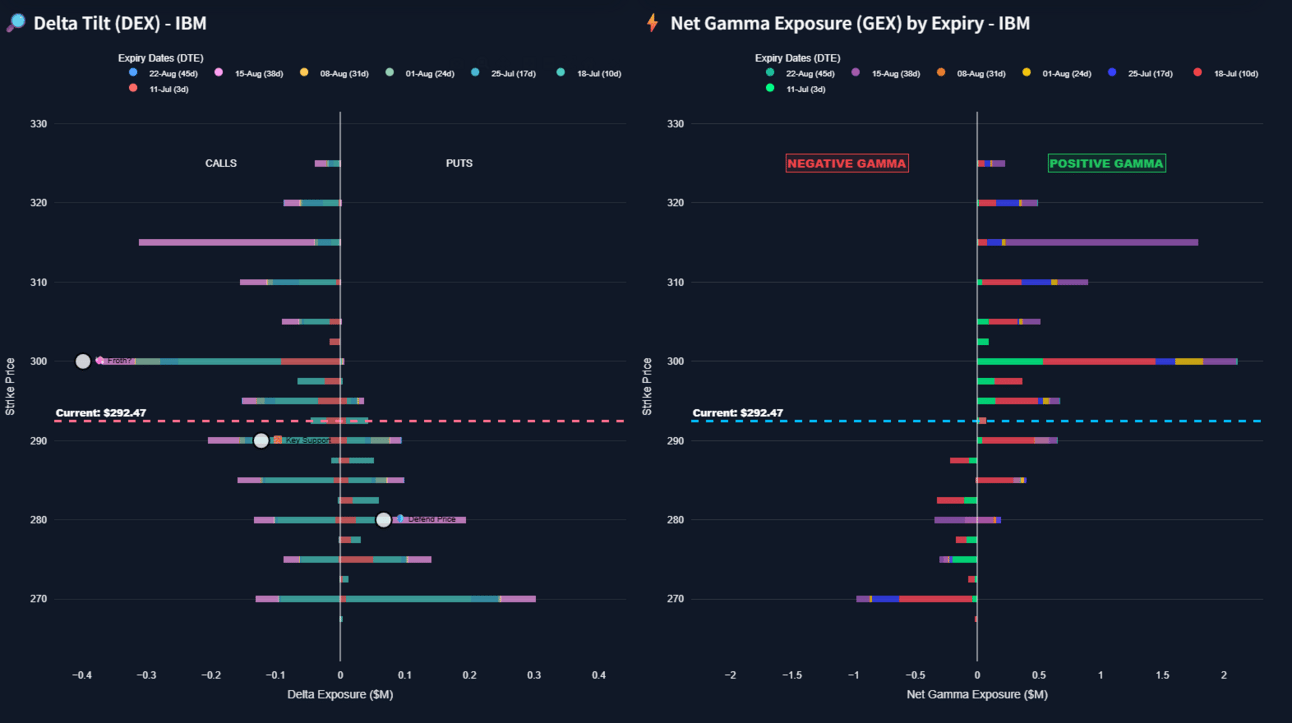

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️