⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $DIS ( ▼ 0.4% ) . Very strong run so far and we think the upside momentum may continue, barring any major negative news developments.

Scroll down to learn more about today’s top idea.

Momentum Shift Up

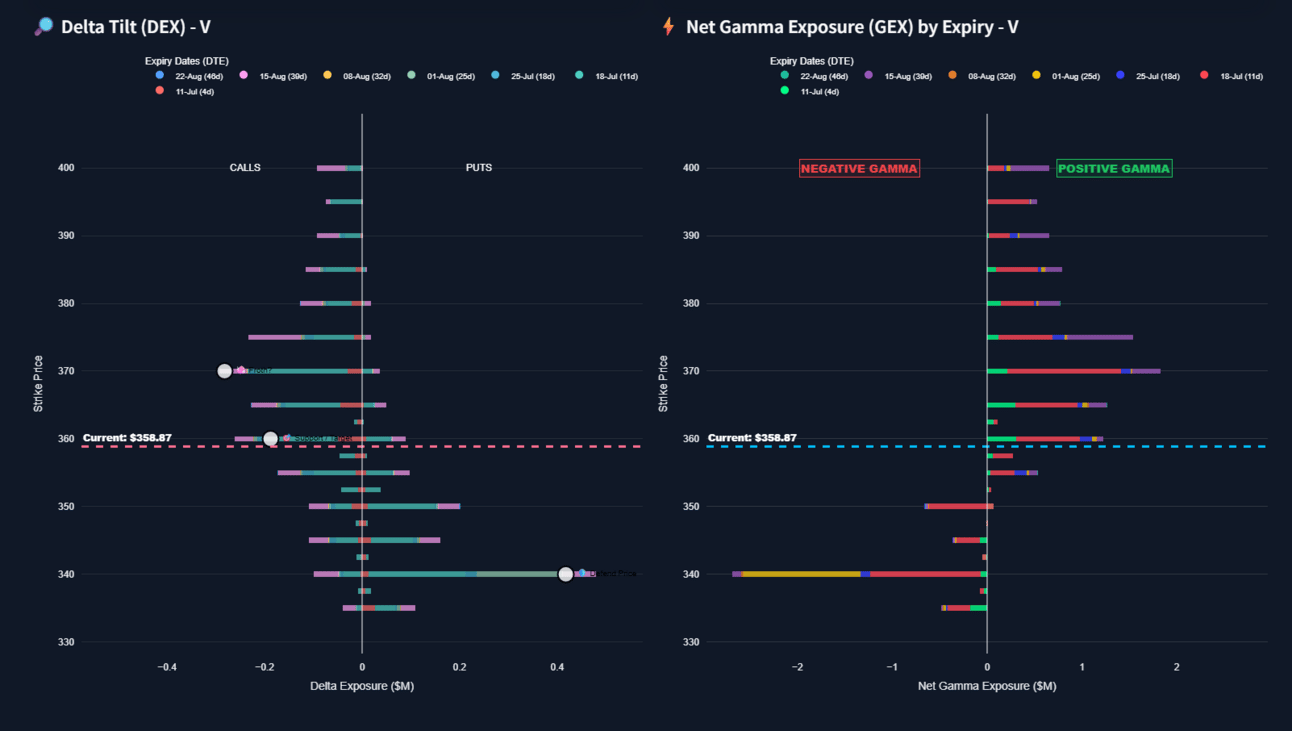

V Delta Tilt and Gamma Exposure

Visa ($V) remains a name we like in the financial sector. Last session, we saw an upward momentum shift on the daily chart. Also, a squeeze formed on the 4-hour timeframe, with the price above the 21 EMA. This looks like a good setup, and we think a trade opportunity could arise this week.

Raw Consensus Score: 1 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

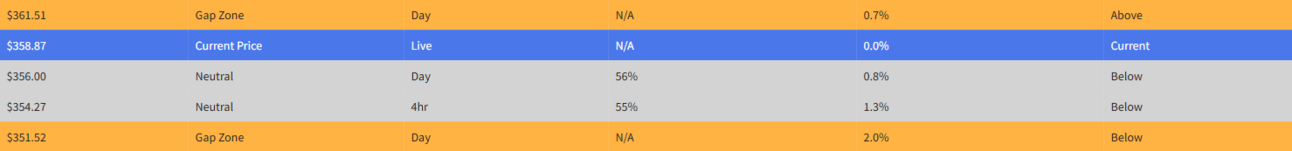

DDOG Delta Tilt and Gamma Exposure

Datadog's ($DDOG) announcement last week about joining the S&P 500 has catapulted the name to new highs. We see strong bullish sentiment, with a large concentration of activity around the $175 area, showing significant positive gamma exposure.

This positive gamma means that as the stock rises, dealers who are short options will need to buy more shares to hedge, creating a self-reinforcing buying trend. $DDOG is definitely one to keep on the radar.

In the short term, the stock appears a bit extended. However, stocks can often rise further than expected in such situations. We will closely monitor the price action for confirmation.

Raw Consensus Score: 7 out of 7 (Extreme momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

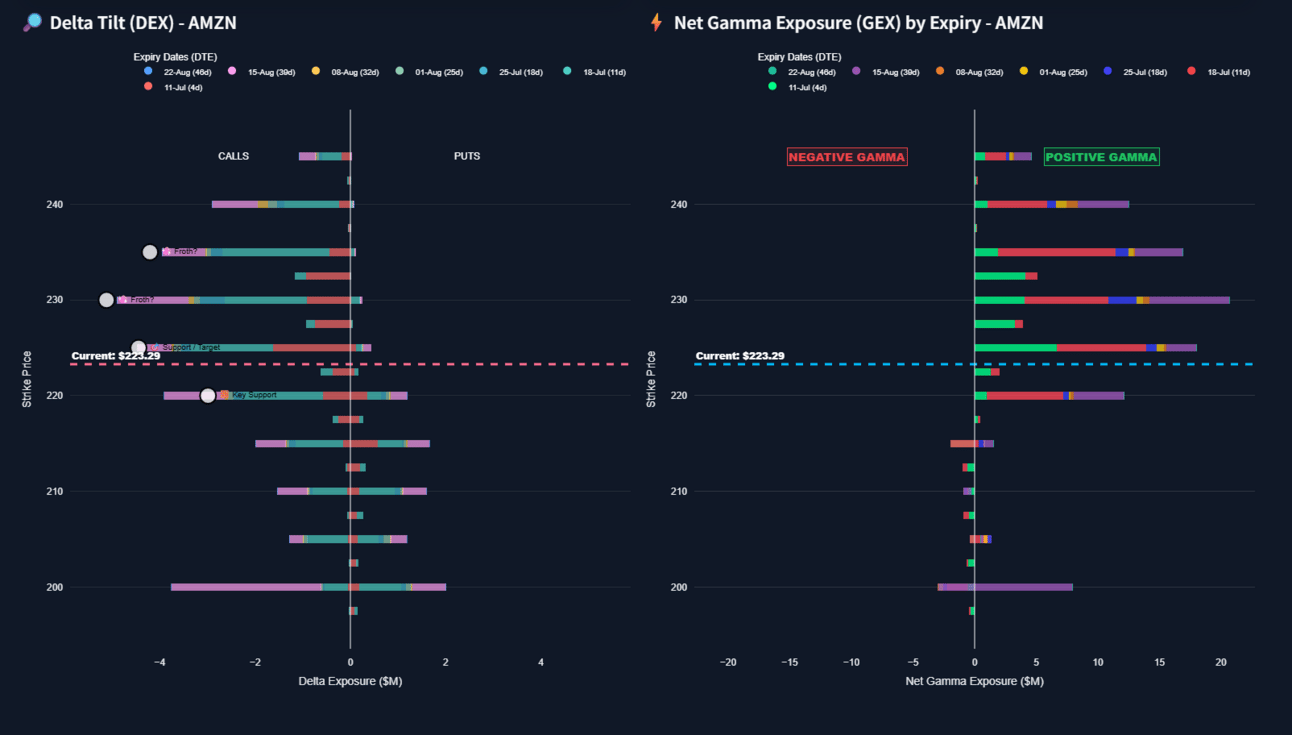

AMZN Delta Tilt and Gamma Exposure

Amazon ($AMZN) is on our radar today. We like the look of its 4-hour chart, especially how the $220 gamma and delta support level has held. This suggests strong support at that price.

However, in the short term, $AMZN may be approaching a critical resistance area at $225. We will be watching this level closely, as it could determine the next significant move.

Raw Consensus Score: 1 out of 7 (Neutral momentum) (Momentum Stars)

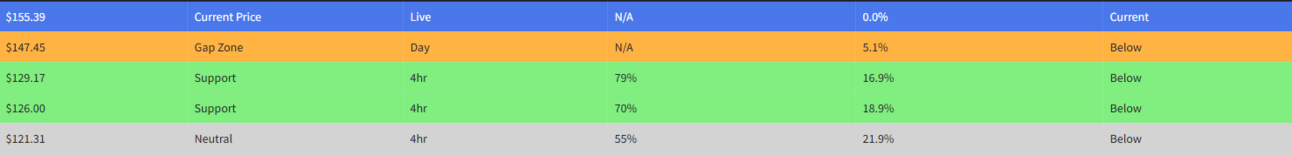

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

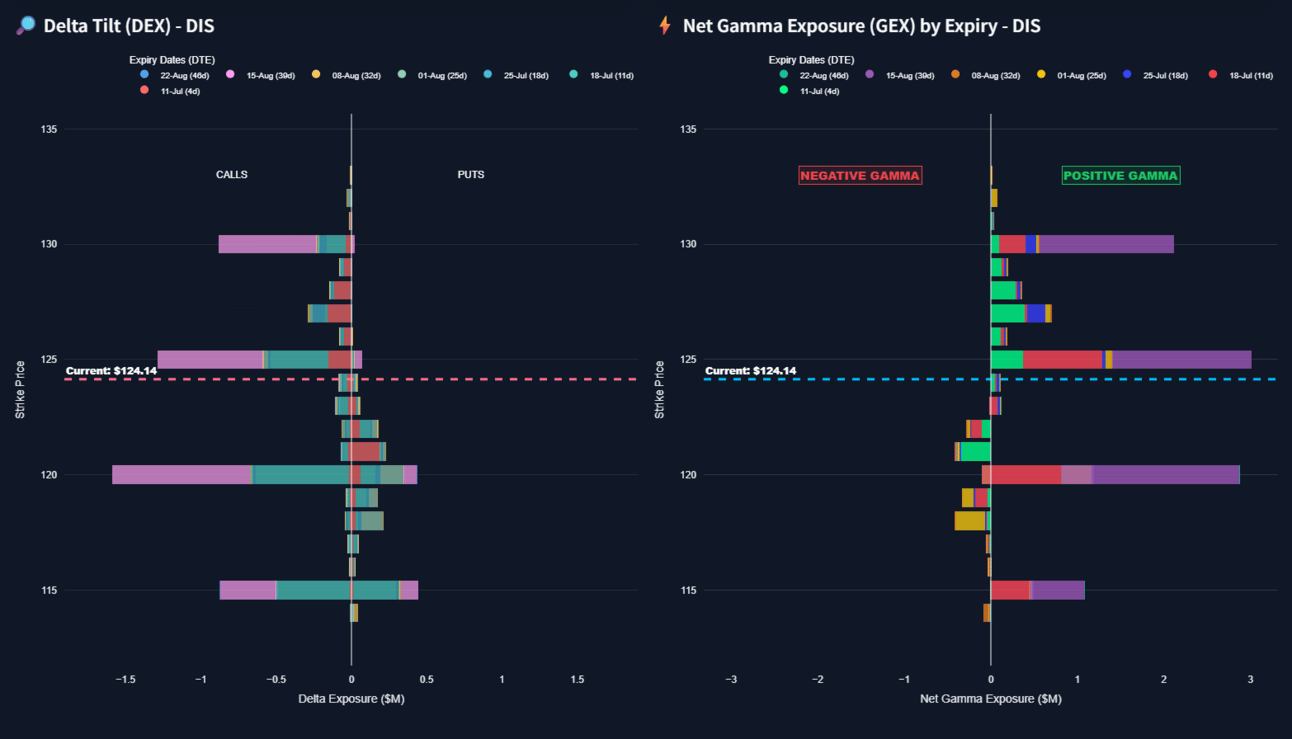

DIS Delta Tilt and Gamma Exposure

Disney ($DIS) has been on a strong run recently, and we expect this to continue for the next few days, barring any major news. It's definitely one to keep on the radar for today.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

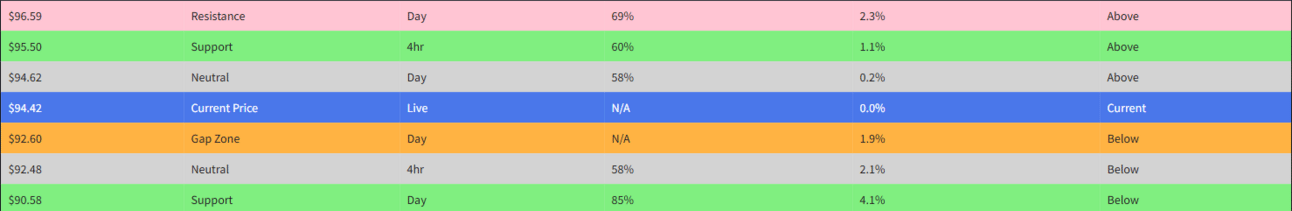

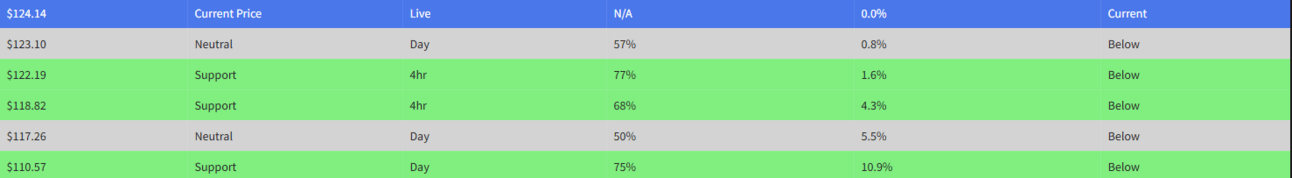

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

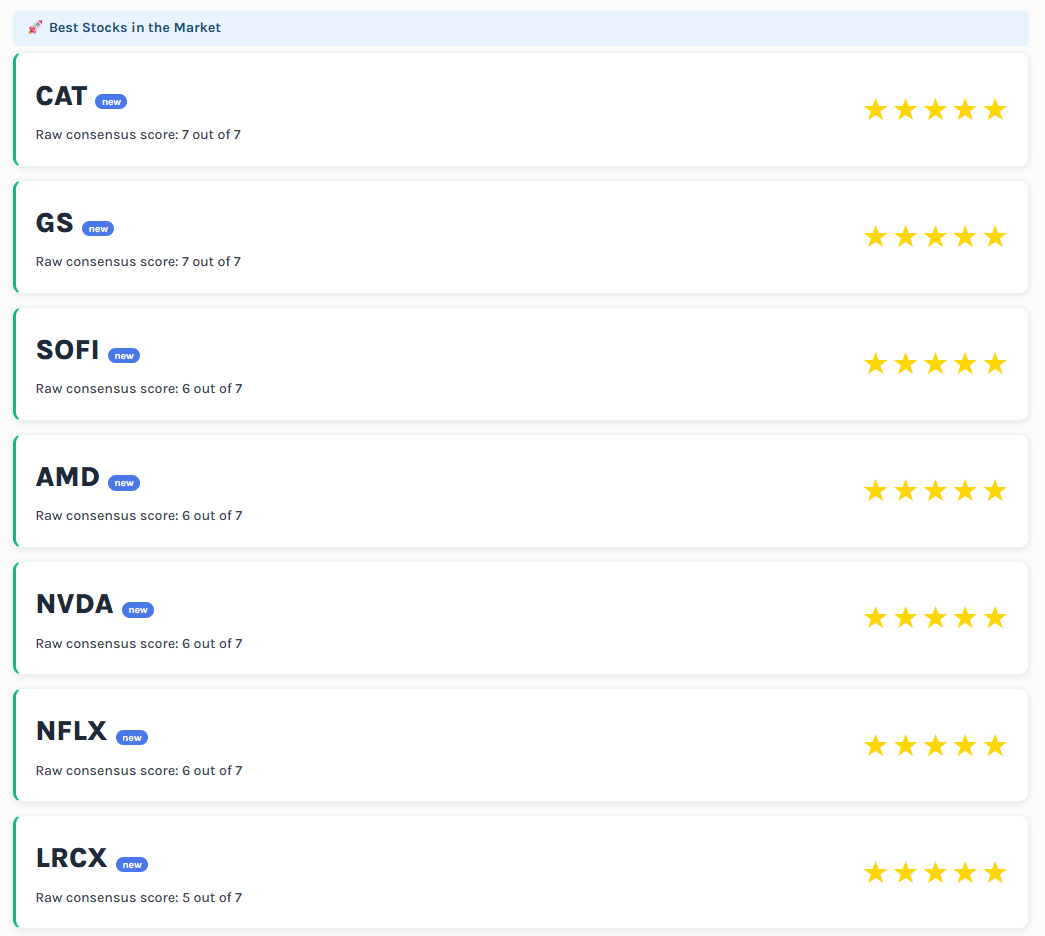

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️