⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $QCOM ( ▲ 1.14% ) . Delta and gamma charts for QCOM looks decently bullish, Scroll down to see the levels we like and are paying attention to.

Scroll down to learn more about today’s top idea.

Consolidation

ABNB Delta Tilt and Gamma Exposure

Airbnb ($ABNB) appeared on our radar yesterday, exhibiting a decently structured daily chart. While the name may not be immediately poised for a sharp leg higher, we are particularly keen on the consolidation it's currently undergoing.

Consolidation, a period where price trades sideways within a relatively narrow range after a prior move, is often a healthy precursor to the next directional move. It allows for a digestion of previous gains or losses and a re-accumulation or distribution phase. The current consolidation in ABNB suggests that sellers may be losing steam and buyers are beginning to step in, or vice-versa, as the market finds a temporary equilibrium.

We believe this orderly consolidation makes $ABNB definitely one to watch.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Consolidating

ABBV Delta Tilt and Gamma Exposure

ABBV (AbbVie Inc.) has shown decent consolidation on the daily chart.

Regarding delta and gamma positioning, long options (both puts and calls) have positive gamma, while short options have negative gamma. Gamma measures how much delta is expected to change when the stock price moves. Higher gamma means delta is expected to change more. Gamma is highest for at-the-money options closer to expiration.

Recent news indicates AbbVie is actively acquiring companies to strengthen its immunology pipeline, which could contribute to stock rotation within the healthcare sector.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

COP Delta Tilt and Gamma Exposure

We traded ConocoPhillips ($COP) yesterday for a quick day trade. We still prefer the look of its chart over other energy names like Chevron ($CVX). While $COP may be a bit extended in the short term, it's definitely one to keep on the radar for future opportunities.

Raw Consensus Score: 2 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

QCOM Delta Tilt and Gamma Exposure

Qualcomm ($QCOM) caught our eye yesterday, but we didn't enter a trade. We like the look of the daily chart, particularly the recent upward momentum shift.

We're watching it today for a potential entry. Specifically, the $165 area is our target. This level appears significant for a possible move higher.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

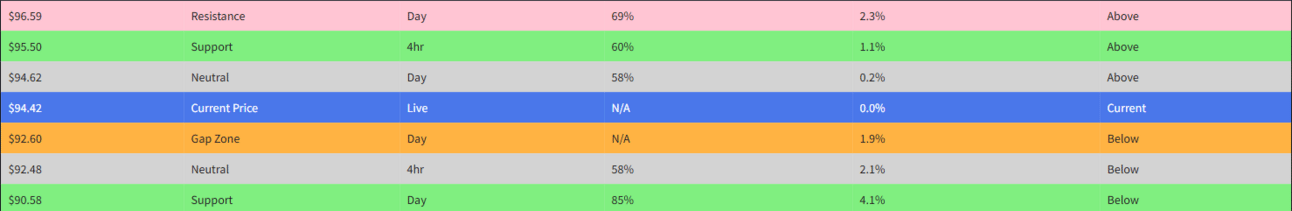

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

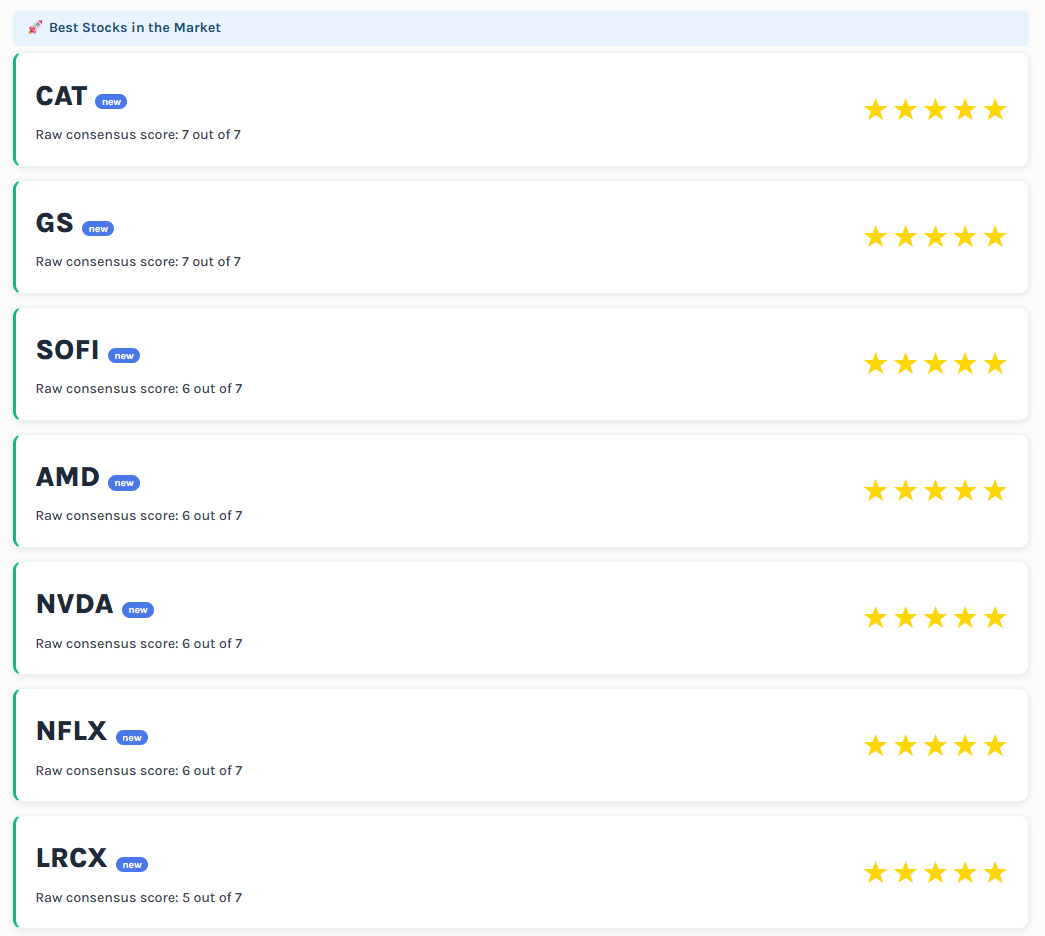

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️