⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $MMM ( ▲ 1.22% ) . Looking for a pullback in the short term into quant levels.

Scroll down to learn more about today’s top idea.

Momentum Shift Up

HUM Delta Tilt and Gamma Exposure

Humana ($HUM), a name we flagged some days ago for a possible bottoming process, continues to show promising signs. Our latest observation reveals a TTM Squeeze forming on the daily chart.

For those unfamiliar, a TTM Squeeze indicates a period of low volatility where price is consolidating, often preceding a significant directional breakout. When the "squeeze fires," it signals an increase in volatility and a likely move out of the tight trading range.

Given the potential for a reversal from its recent drawdown and the development of this powerful technical pattern, $HUM is definitely worth putting on your radar for the days ahead. We will be closely monitoring for a breakout from this squeeze.

Raw Consensus Score: 1 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

HD Delta Tilt and Gamma Exposure

Home Depot ($HD) appears to have established a short-term bottom on its daily chart, following a period of downward pricing pressure over the past few weeks. This observed stabilization suggests a potential shift in the immediate trend.

We view this development constructively, as it could present an opportunity to "pick up on some pullbacks." This strategy involves looking for slight retracements from newly formed support levels to initiate long positions with a more favorable risk-to-reward profile. While the overall long-term trend still requires further confirmation of a complete reversal, the short-term bottoming process makes $HD a name we like for potential upside on opportune dips. We will be closely monitoring price action for clear entry signals.

Raw Consensus Score: 2 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

NBIS Delta Tilt and Gamma Exposure

$NBIS continues to impress on the daily chart, maintaining its strong upward trajectory. We are particularly encouraged by the persistent momentum observed in this name. Its consistent performance suggests underlying strength and continued interest from market participants, making it a compelling stock to watch for further upside.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

HON Delta Tilt and Gamma Exposure

3M Company ($MMM) has recently appeared on our radar, alongside other industrial sector names like GE, BA and HON, exhibiting an attractive technical setup on the daily chart.

While we like the overall look of the daily chart, in the short term, we are looking for a pullback into our quantitative levels to establish positions. This strategy aims to capitalize on any temporary dips, allowing for more favorable risk-to-reward entries. We believe that such pullbacks could present a good opportunity to accumulate shares in this industrial stalwart, given the broader positive sentiment emerging in the sector. We will be monitoring price action closely for confirmation of these optimal entry zones.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

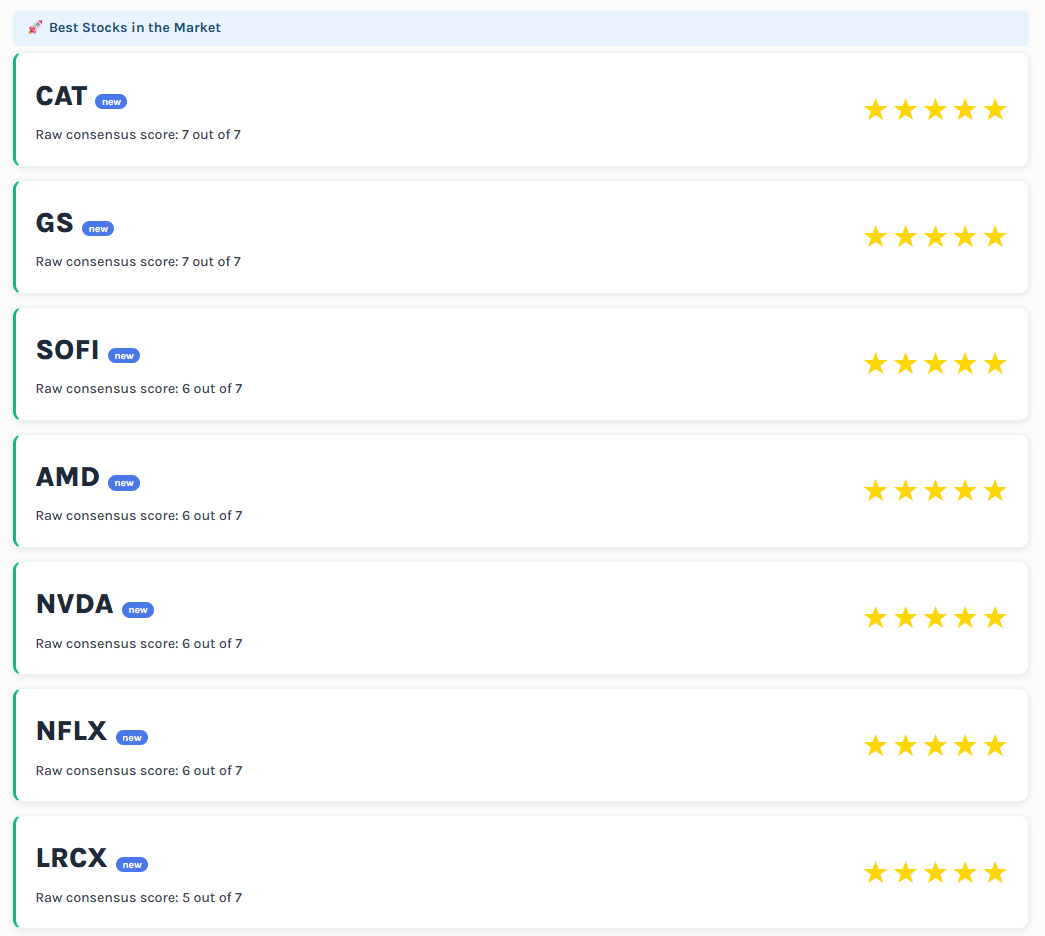

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️