⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $TSLA ( ▲ 0.03% ) . Production and deliveries report before the bell. Scroll to see levels we are watching below.

Scroll down to learn more about today’s top idea.

Momentum Up

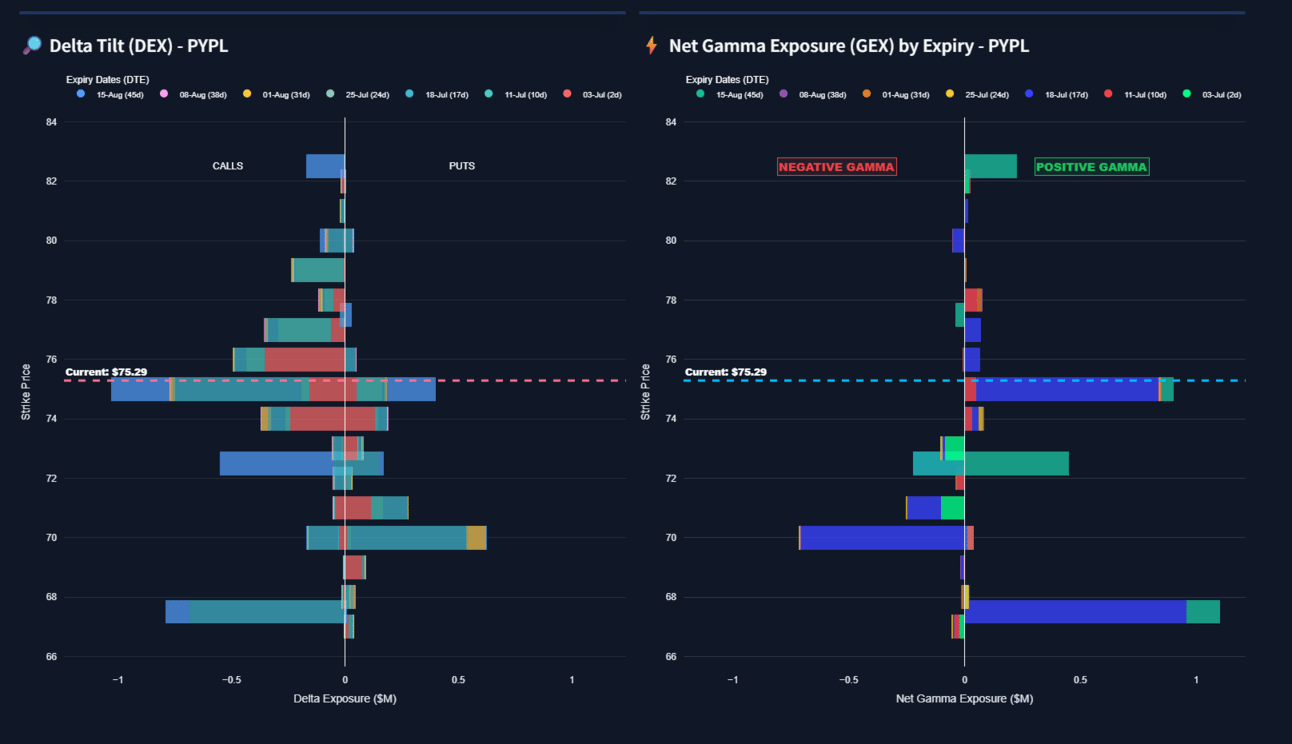

PYPL Delta Tilt and Gamma Exposure

PayPal ($PYPL) has recently registered on our momentum scanner, indicating a significant surge in its recent price action. Looking at the daily chart, we find the overall technical setup quite appealing, suggesting underlying strength.

However, in the short term, the name might be considered a bit extended and could be due for a pause or minor retracement. We will therefore be watching intently for a healthy pullback into our quantitative levels.

Raw Consensus Score: 2 out of 7 (Bullish momentum) (Momentum Stars)

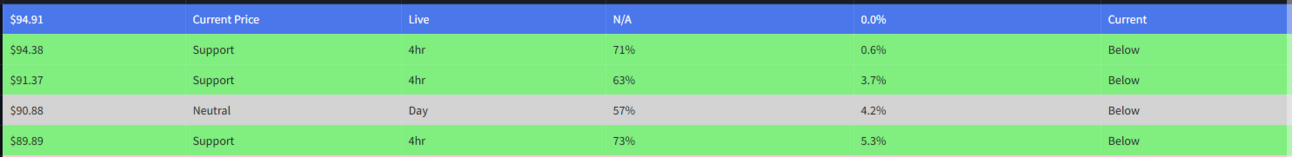

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

SBUX Delta Tilt and Gamma Exposure

Starbucks ($SBUX) continues to be a name with a highly favorable momentum rating in our analysis. After a brief pause in price action over the past few days, the stock appears to be poised to resume its uptrend.

This period of consolidation, often seen as a healthy reset, suggests that underlying buying pressure remains strong and is preparing for a fresh push higher. Given its established positive momentum, $SBUX is definitely one to keep on your radar for a potential "next leg up" in the coming sessions. We will be closely monitoring for confirmation of this renewed upward trajectory.

Raw Consensus Score: 3 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Bottoming

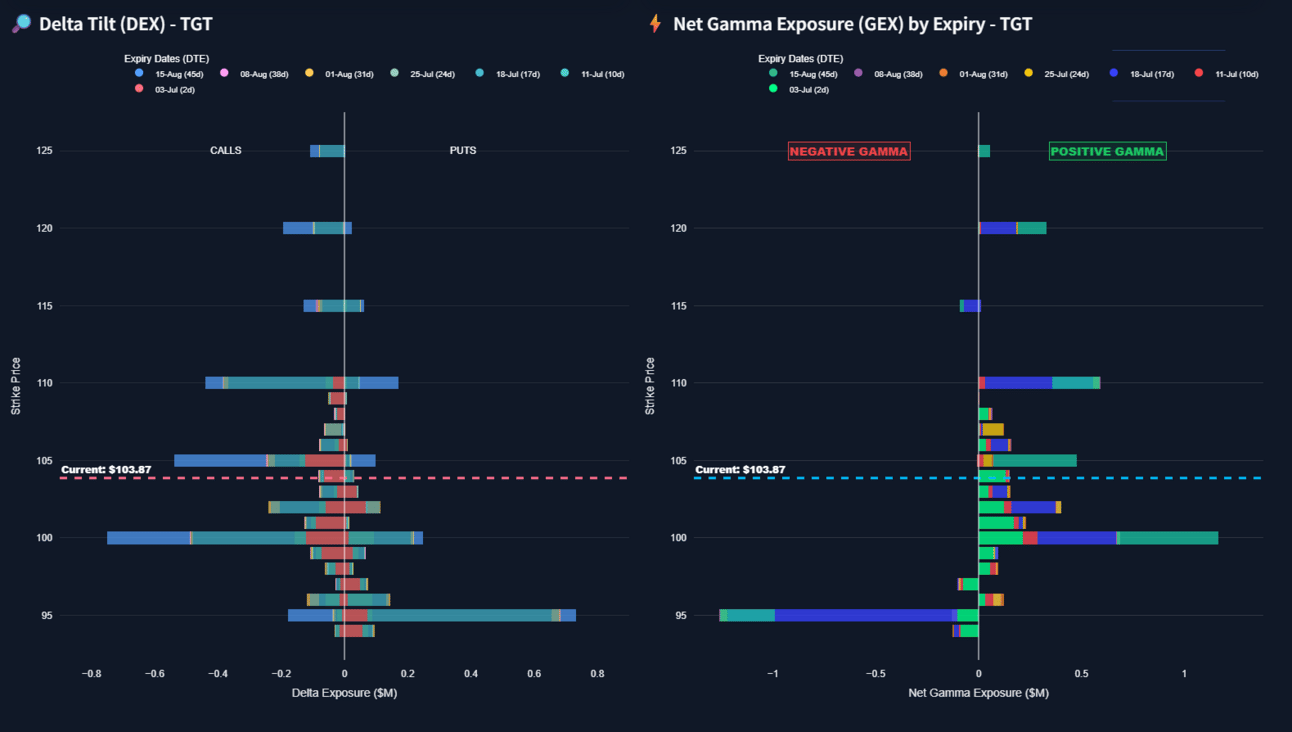

TGT Delta Tilt and Gamma Exposure

Target ($TGT) is presenting an interesting picture on the daily chart, marked by a very aggressive upward move yesterday, July 1, 2025. This strong surge suggests the possibility that the name may be starting a bottoming process after a period of downward pressure.

While yesterday's move was indeed impressive and has likely caught the attention of many, we remain cautious that $TGT has fully bottomed out just yet. Despite having a raw consensus score of 5 out of 7 on our "Momentum Stars" list (indicating significant recent positive momentum), a single strong day doesn't necessarily confirm a reversal of a larger downtrend.

Raw Consensus Score: 5 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

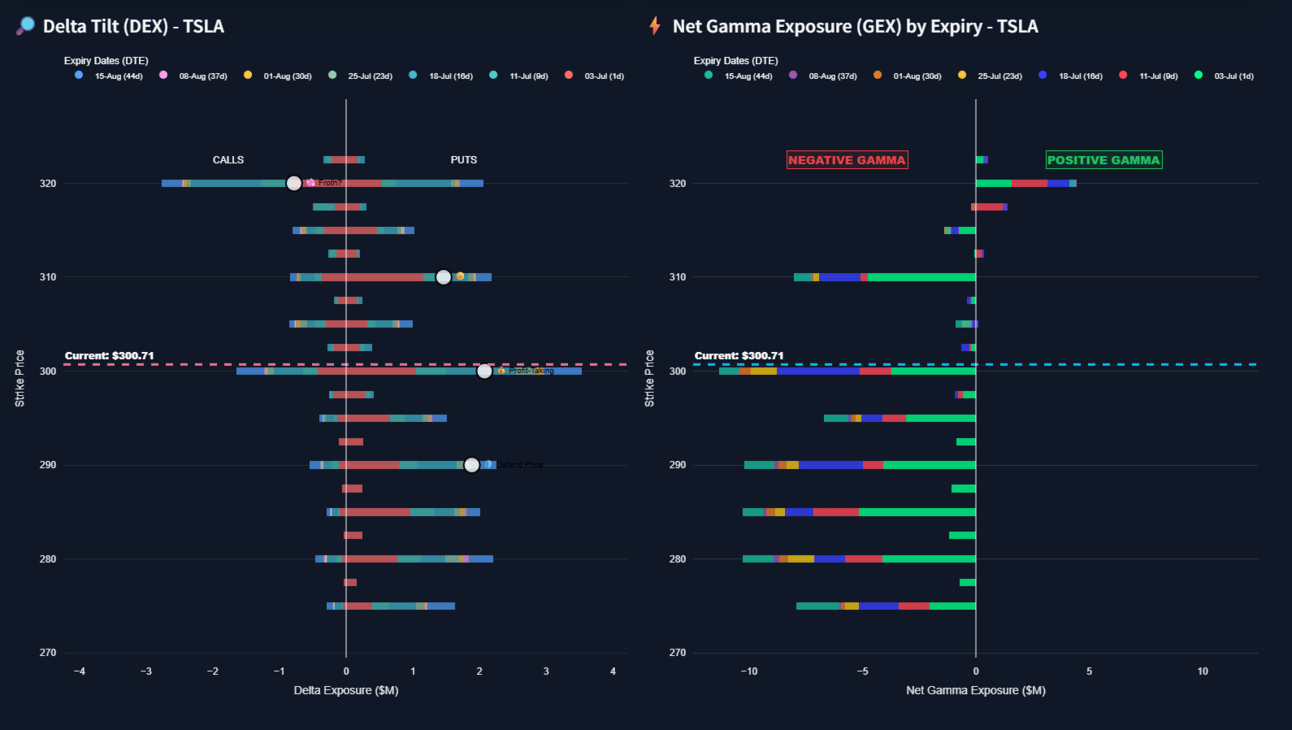

TSLA Delta Tilt and Gamma Exposure

Tesla ($TSLA) is a primary focus for today's trading session as the market awaits the release of its Q2 2025 production and delivery numbers. This announcement is expected to be a significant catalyst for price action, making $TSLA a pure momentum play for the day.

The $320 level is identified as a critical point, notably due to some significant dealer gamma at this strike. "Dealer gamma" refers to the collective gamma exposure of market makers (dealers) who are typically short options to facilitate trading. As the underlying stock price approaches heavily traded strike prices, dealers must adjust their hedges by buying or selling the underlying shares to remain delta-neutral.

If $TSLA breaks decisively above the $320 area, we could see some gamma squeeze type action. A gamma squeeze occurs when a rapid increase in the underlying stock price (often fueled by call option buying) forces market makers who have sold call options to buy more shares to hedge their growing delta exposure. This creates a self-reinforcing cycle of buying that can accelerate the stock's upward movement.

However, it is crucial to note that our internal momentum systems still classify $TSLA as bearish. This indicates that despite the potential for a short-term squeeze, the longer-term trend or broader momentum indicators may still be pointing downwards. Therefore, trade carefully and be mindful of the inherent volatility and potential for quick reversals, especially given the news-driven nature of today's price action.

Raw Consensus Score: -3 out of 7 (Bearish momentum) (Momentum Stars)

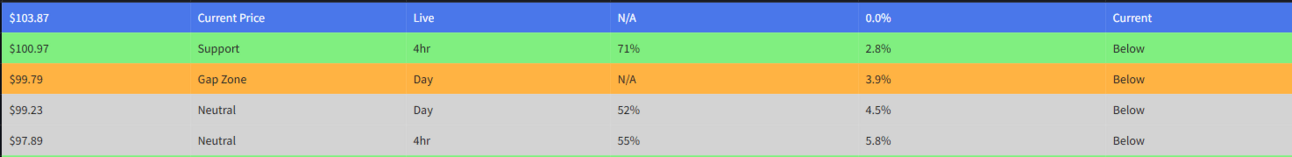

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

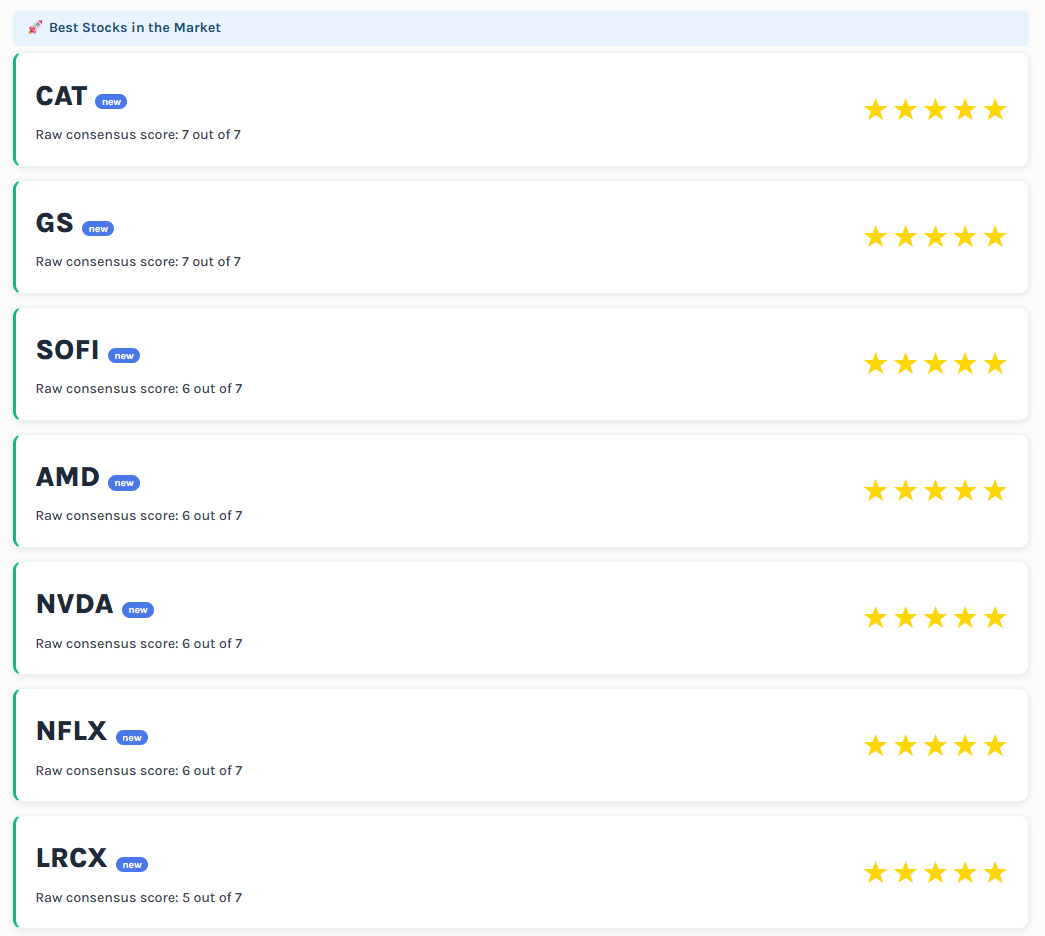

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️