⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $HON ( ▲ 1.33% ) . Pullback after momentum burst. We like the look of the daily chart (very much so)

Scroll down to learn more about today’s top idea.

Momentum Shift Up

SBUX Delta Tilt and Gamma Exposure

Starbucks ($SBUX) is exhibiting an impressive technical setup on its daily chart, especially following a recent minor pullback. This consolidation appears to have reset some short-term momentum, paving the way for potential renewed upward movement.

Our analysis points to $95 as a key bullish target area for the stock. The current price action suggests that despite recent fluctuations, the underlying positive sentiment remains intact, making $SBUX a compelling name to watch for a move toward this level.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

NBIS Delta Tilt and Gamma Exposure

Nike ($NKE) has demonstrated a highly impressive reaction to its recent earnings report, signaling a significant shift in market sentiment. The stock saw a considerable surge in after-hours trading following the release of its fiscal fourth-quarter results, despite a reported 12% revenue decrease and a warning of a potential $1 billion hit from tariffs. Investors appear to be focusing on the better-than-expected EPS ($0.14 vs. $0.12 consensus) and, more importantly, management's forward-looking guidance and strategic initiatives to mitigate headwinds and re-ignite brand momentum.

We will be closely watching $NKE today to see if this strong post-earnings momentum can be sustained and lead to further upside. The market's positive response suggests a renewed optimism in Nike's turnaround plan under CEO Elliott Hill, making it a compelling name to monitor for continued strength throughout the trading session.

Raw Consensus Score: 2 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Bottoming

BOIL Quant Levels

The ProShares Ultra Bloomberg Natural Gas ETF ($BOIL), which provides leveraged exposure to natural gas futures, has experienced record volatility since the escalation of Middle East tensions. This correlation highlights the interconnectedness of global energy markets and the impact of geopolitical events.

However, a closer look at the daily chart for $BOIL suggests that the name could be in the process of bottoming. While highly volatile, current price action indicates a potential stabilization or accumulation phase after significant declines. This makes $BOIL one to keep a very close eye on. We will be monitoring for confirmed signs of a trend reversal, such as higher lows or a sustained break above key resistance levels, which would indicate a more definitive bottoming formation.

Raw Consensus Score: N/A (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

HON Delta Tilt and Gamma Exposure

Honeywell International ($HON) is a name that has caught our attention on the daily chart, and we are quite excited about this discovery. The stock recently experienced a great pullback after a decent run-up, which often presents an attractive entry opportunity for traders.

This type of price action, where a stock consolidates or retraces after a period of strong gains, can indicate healthy price discovery and a potential reset before the next leg higher. We like the current technical setup on the daily chart and will be closely monitoring $HON for signs of renewed upward momentum.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

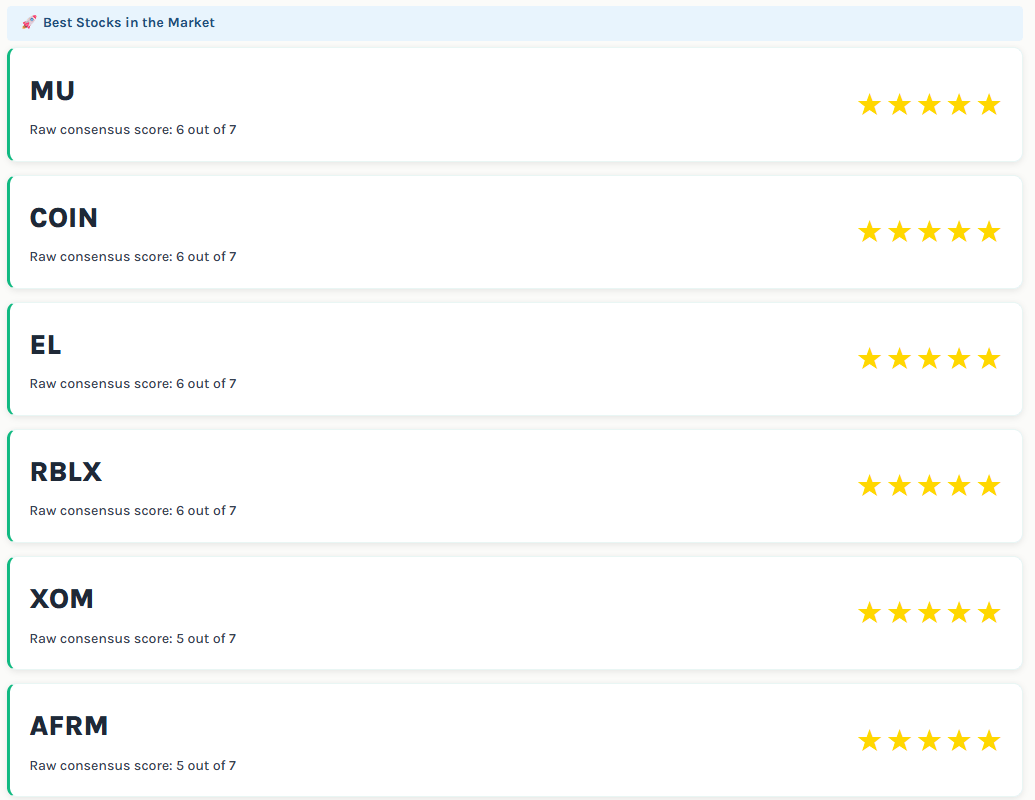

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️