⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $OKLO ( ▼ 5.63% ) . Mixed momentum could provide opportunity for short sellers.

Scroll down to learn more about today’s top idea.

Momentum Shift Up

BRK-B Delta Tilt and Gamma Exposure

Berkshire Hathaway Class B ($BRK-B) has been in a notable drawdown over the past few weeks. However, our analysis suggests that the name is now attempting to establish a bottoming process on the daily chart.

This nascent pattern could present an interesting opportunity for long-side trades. While it's still early in the formation, we are closely monitoring for confirming signals such as increased buying volume, a shift in momentum indicators, or the establishment of higher lows. Should these technical confirmations materialize, $BRK-B could offer a favorable risk-to-reward setup for accumulation. Additionally, the XLF sector and names pushing higher we think BRK-B could begin it’s bottoming process as well.

Raw Consensus Score: 1 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

NBIS Delta Tilt and Gamma Exposure

Nebius Group ($NBIS), is a player in the semiconductor space, continues to be on our radar and is demonstrating decent strength to the upside. Our internal momentum scoring system assigns $NBIS a score of 4 out of 7, indicating solid positive momentum.

We believe there's potential for the stock to push higher still, with dips likely to be bought. This conviction is further supported by the Delta Tilt chart, which shows bullish positioning in the options market. This suggests that options traders are anticipating further upside, and their hedging activities could contribute to continued upward pressure and support on pullbacks.

Raw Consensus Score: 4 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

HOOD Delta Tilt and Gamma Exposure

Robinhood Markets ($HOOD) continues to assert itself as a formidable momentum leader, exhibiting very impressive strength to the upside on the daily chart over the past few weeks.

Our internal momentum scoring system assigns $HOOD a score of 5 out of 7, further validating its robust upward trajectory. As the stock pushes higher, we will be closely monitoring the $80 level to observe if it acts as a significant support or resistance point, and whether the strong buying pressure can sustain price action above it. The ability of $HOOD to hold this level will be a key indicator for its continued momentum.

Raw Consensus Score: 5 out of 7 (Very Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

ORCL Delta Tilt and Gamma Exposure

The momentum on Oracle's ($ORCL) daily chart is undeniably strong, commanding attention from traders and investors alike. The stock is currently exhibiting significant upward drive, putting it in a pivotal position.

We are anticipating a decisive move here. Either $ORCL will continue its ascent, potentially breaking into new all-time highs, or it could face a sharp rejection if buying pressure exhausts. This makes it a high-conviction watch for significant action today, demanding close observation for confirmation of its next directional move.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

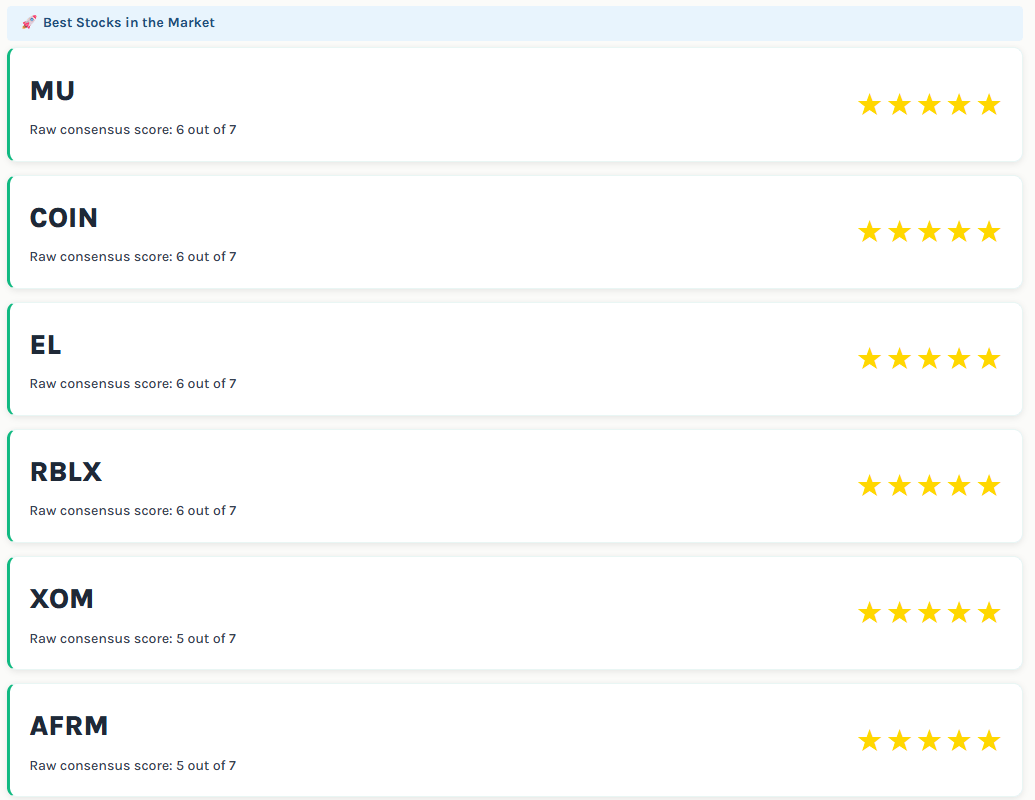

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️