⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $OKLO ( ▼ 5.63% ) . Mixed momentum could provide opportunity for short sellers.

Scroll down to learn more about today’s top idea.

Momentum Up

JPM Delta Tilt and Gamma Exposure

JPMorgan Chase ($JPM) is currently maintaining its impressive upward trajectory, continuing a strong run observed on the daily chart. While there's a possibility that short-term momentum may experience a slight deceleration, the underlying strength of this name suggests it is definitely "still rocking and rolling."

The sustained bullish performance in $JPM underscores its robust fundamentals and strong market confidence within the financial sector. Even if we see a minor pause in its immediate ascent, the broader trend remains highly constructive, positioning $JPM as a resilient performer. We will continue to monitor its price action for any significant shifts, but the overall outlook remains positive.

Raw Consensus Score: 5 out of 7 (Bullish momentum) (Momentum Stars)

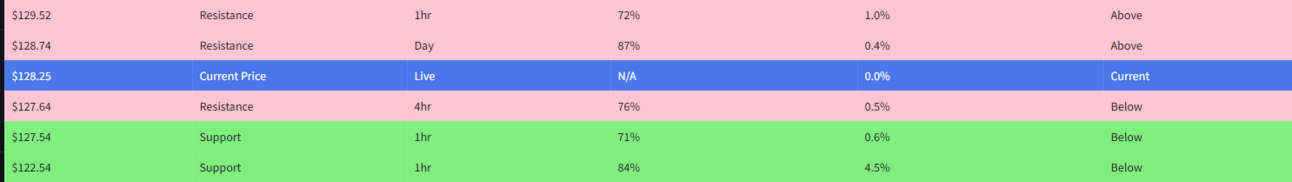

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

CMG Delta Tilt and Gamma Exposure

Chipotle Mexican Grill ($CMG), which we highlighted last week as consolidating on the daily chart, now appears to be exhibiting signs of being ready for a breakout.

The stock has been trading within a defined range, approximately between $49 and $53 on the daily timeframe, with no clear directional bias recently. However, a squeeze formation has been developing on the daily chart for some time. This pattern often precedes a significant price movement, indicating a buildup of energy that can lead to a sharp burst of momentum in either direction.

While short-term momentum is currently showing some signs of cooling, which suggests it might be a bit extended, the potential for a larger move out of this consolidation makes $CMG a name to keep a very close eye on. We'll be watching for a decisive break from its established range to confirm the direction of the next move.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

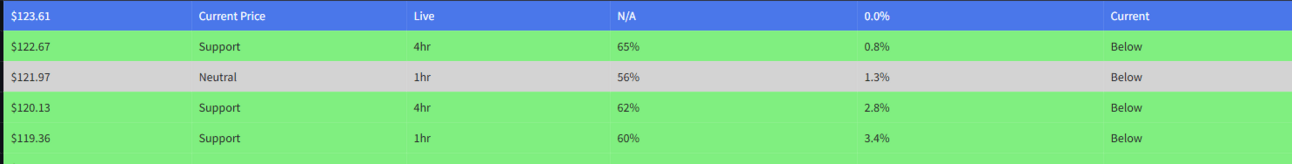

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

MO Delta Tilt and Gamma Exposure

Altria Group ($MO) is presenting a highly interesting setup on the daily chart as it approaches new all-time highs. This upward trajectory is supported by clear signs of building momentum on the daily timeframe.

The stock's ability to challenge its previous peak, coupled with increasing momentum, suggests strong underlying buying pressure and investor confidence. $MO is certainly one to watch closely for potential breakout opportunities as it tests these significant price levels.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

OKLO Delta Tilt and Gamma Exposure

Oklo ($OKLO) is a name under close scrutiny today, poised for significant price action. Our analysis indicates that $55.00 appears to be a critical level of support.

However, the daily chart suggests that the stock has sustained some technical damage recently, indicating a shift in its short-term structure. Given this technical weakness, we will be watching for potential entries if short sellers steps in around the $60.00 area. This level could act as a significant resistance point where bearish participants might look to initiate positions.

It's crucial to acknowledge the dynamic nature of this situation and monitor price action closely for confirmation of either support holding or a continuation of the downside.

Raw Consensus Score: -1 out of 7 (Bearish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

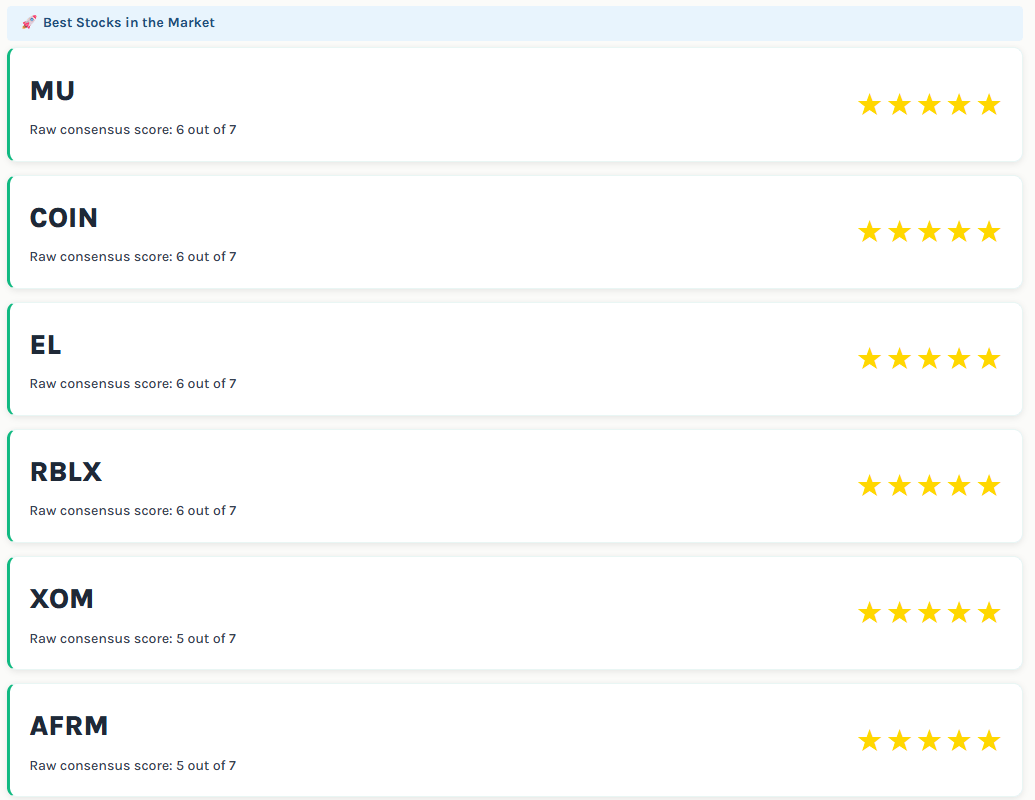

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️