⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $CCJ ( ▲ 1.95% ) . Momentum Shift Up (Bullish Momentum)

Scroll down to learn more about today’s top idea.

Momentum Up

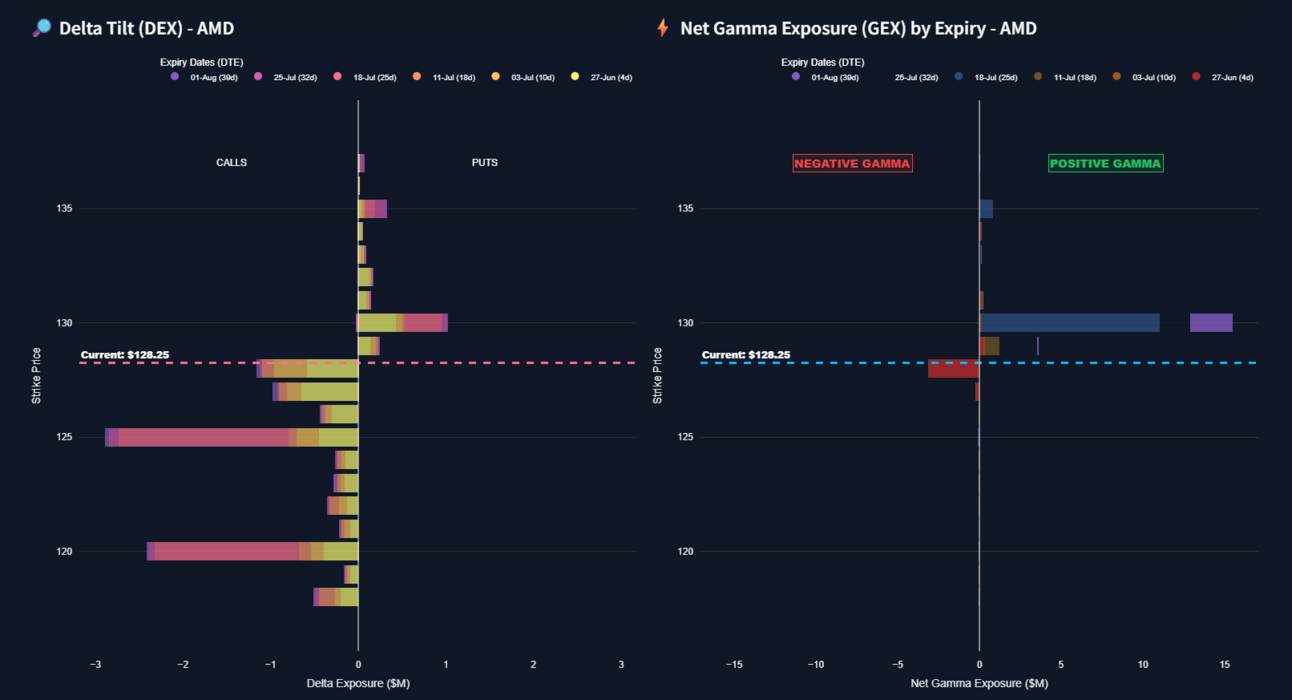

AMD Delta Tilt and Gamma Exposure

Advanced Micro Devices ($AMD) is extending its upward movement in pre-market trading today, Monday, June 23, 2025. This continuation of strength solidifies its position on our "best stocks in the market" list, driven by its robust momentum.

The consistent bullish price action in $AMD highlights its continued relevance in the semiconductor space, particularly within the ongoing AI theme. We will be closely monitoring how this pre-market strength translates into the regular trading session.

Raw Consensus Score: 5 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Up

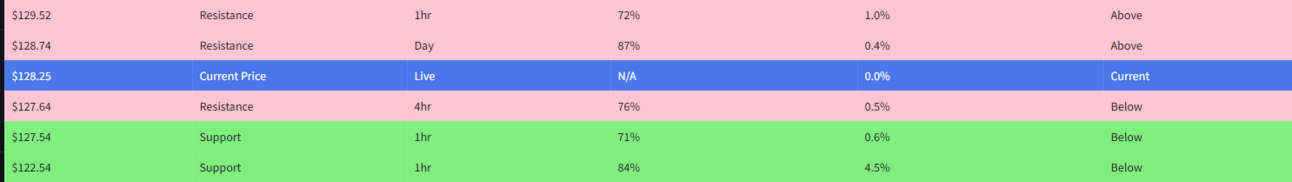

MU Delta Tilt and Gamma Exposure

Micron Technology ($MU) is another key semiconductor name under close observation today. It continues to feature prominently on our "Bullish Momentum Stars" list, reflecting its status as one of the market's strongest momentum stocks.

This week is particularly significant for $MU as the company is scheduled to report earnings. We expect these results, coupled with the ongoing narrative around the AI theme, to be a primary driver of price action. Given its sustained momentum, we will be watching $MU closely for trading opportunities today and as it reacts to its earnings release.

(Note: "Momentum Stars" and "best stock in the market list based on momentum" are terms used by your proprietary analytical framework to highlight stocks exhibiting strong directional price movement over a defined period.)

Raw Consensus Score: 6 out of 7 (Extreme Bullish momentum) (Momentum Stars)

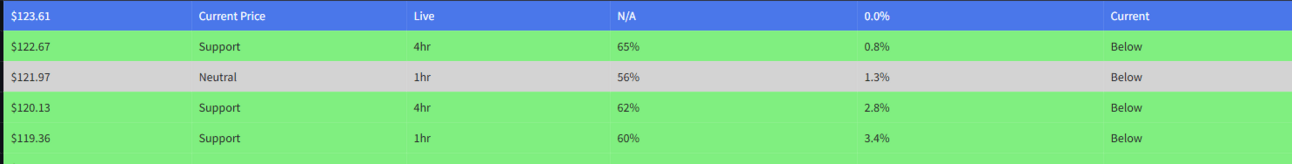

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Down

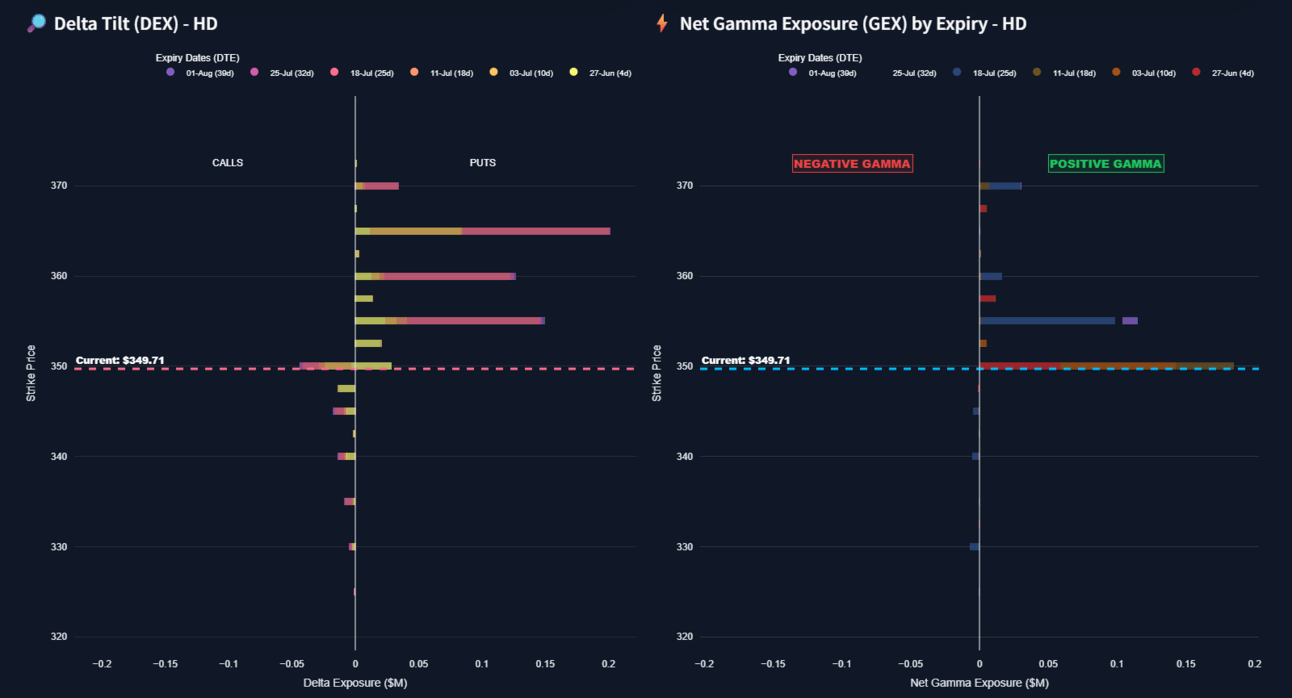

HD Delta Tilt and Gamma Exposure

Home Depot ($HD) has been experiencing notable downward pricing pressure over the last few weeks. This consistent decline positions the name on our radar for a potential bottoming process.

While we are actively monitoring for signs of stabilization and a reversal in trend, it is crucial to emphasize that price action remains the ultimate arbiter. Currently, $HD is still firmly in a downtrend. We will be looking for technical confirmations, such as a shift in momentum, higher lows, or increased accumulation volume, to signal a true bottoming formation. Until such signals emerge, caution is warranted.

Raw Consensus Score: -1 out of 7 (Bearish Neutral momentum) (Momentum Stars)

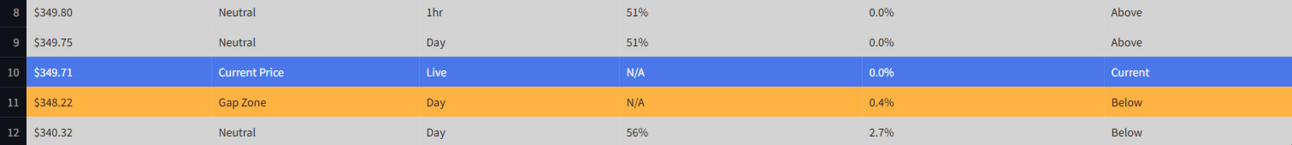

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

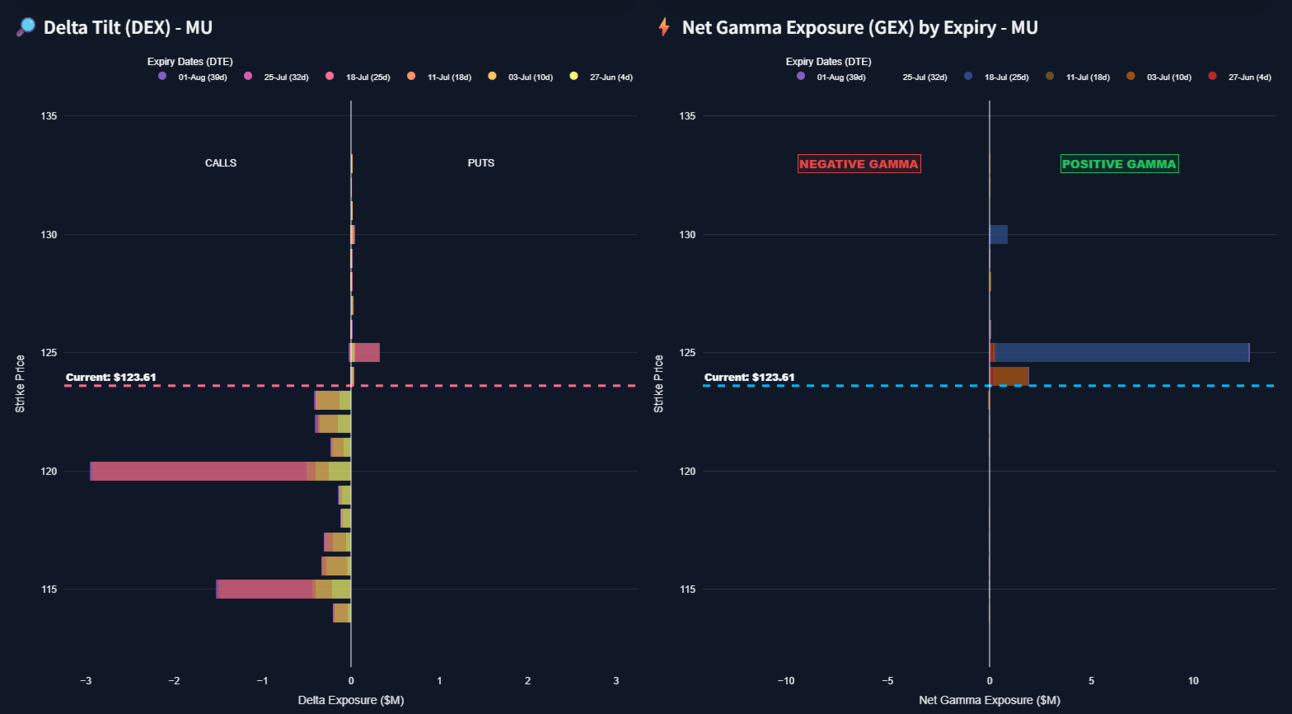

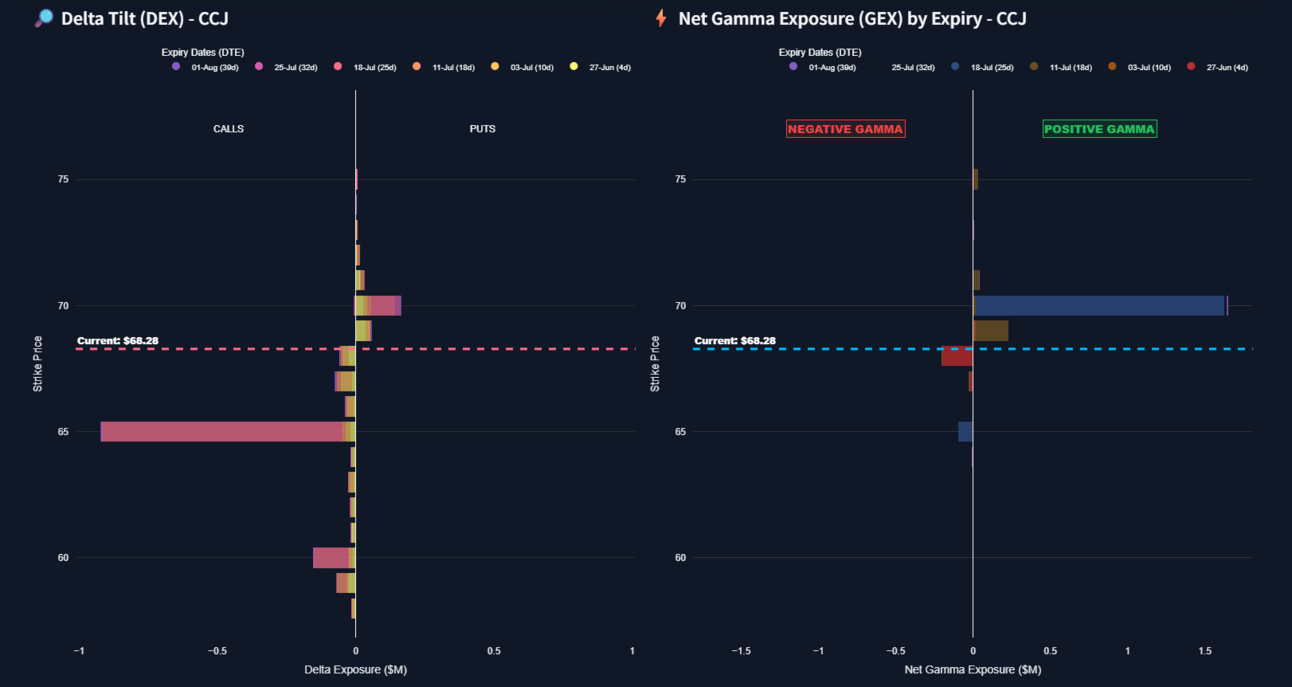

CCJ Delta Tilt and Gamma Exposure

CCJ is a name we are watching closely today for some action.

Raw Consensus Score: 3 out of 7 (Bullish momentum) (Momentum Stars)

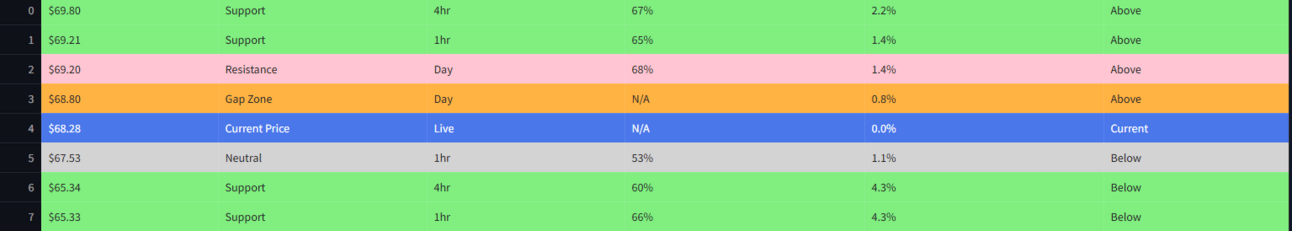

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

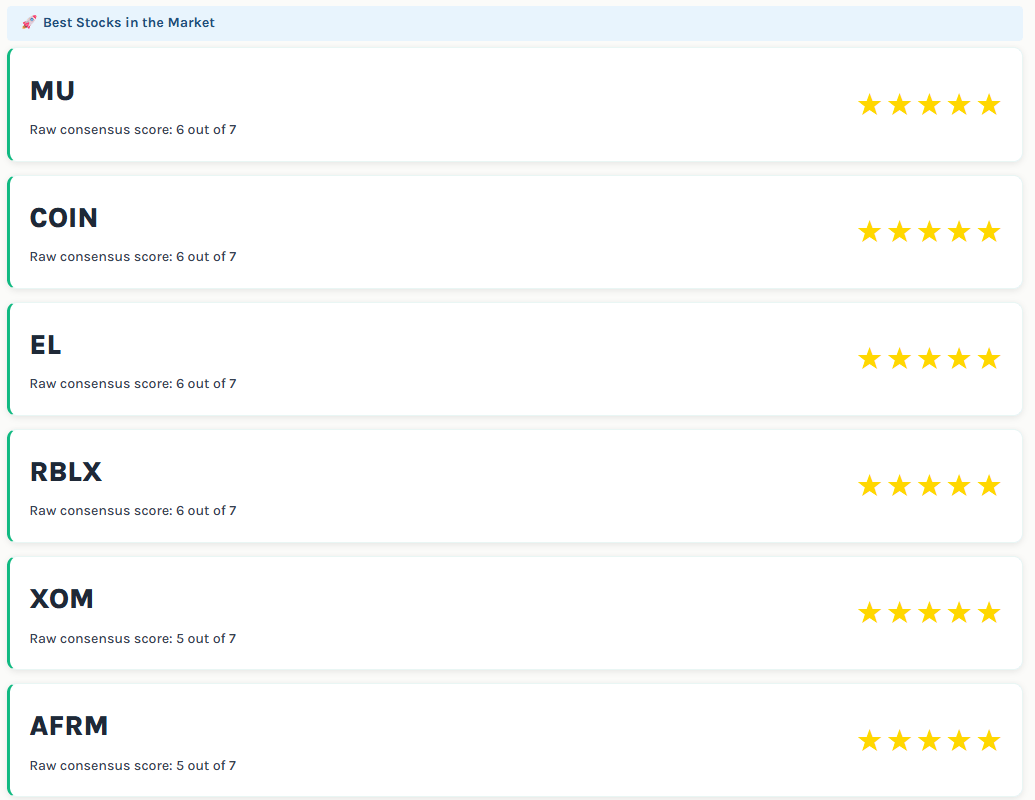

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️