⚠️ DISCLAIMER: The content provided in Trading Signal Field Notes is for informational and educational purposes only. Nothing in this newsletter should be considered financial, investment, or trading advice. Markets carry risk, and you are solely responsible for your own trading and investment decisions. Always do your own research or consult with a licensed financial advisor before taking action based on any information presented.

👁️ Eyes on $NEM ( ▼ 2.61% ) . Looking for a pullback in the short term into quant levels for support. Hot zones today at 10am ET for JOLTS job report and ISM Manufacturing reports.

Scroll down to learn more about today’s top idea.

Momentum Up

DDOG Delta Tilt and Gamma Exposure

Datadog ($DDOG) is currently exhibiting very respectful momentum on its daily chart, suggesting a strong likelihood of continued upward movement. The price action appears robust and indicative of persistent buying interest.

However, in the short term, the name might be considered slightly too extended. This implies that while the underlying trend is strong, a brief pause, consolidation, or minor pullback could occur as momentum cools off from its rapid ascent. Despite this potential for a short-term breather, the overall technical picture on the daily chart remains bullish, and we will be monitoring for opportunities to capitalize on any sustained upward push.

Raw Consensus Score: 4 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

V (Visa) Delta Tilt and Gamma Exposure

Visa ($V) is a name currently on our radar, as we are observing for the initiation of a bottoming process following a swift downward momentum witnessed last week.

The stock experienced a significant decline, prompting us to monitor for signs of stabilization and potential reversal. While it's too early to confirm a definitive bottom, we are closely watching price action for indications such as increased buying volume, the formation of higher lows, or a break above short-term resistance levels.

Raw Consensus Score: 0 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Momentum Shift Up

PANW Delta Tilt and Gamma Exposure

Palo Alto Networks ($PANW) has recently appeared on our radar due to a fresh linear regression reversal on the daily chart. This technical signal suggests a potential shift in the stock's trend, moving from a period of consolidation or slight weakness to a renewed upward bias.

We particularly like the fact that $PANW has been consolidating at highs for some time now. This sideways price action, following a strong run, often indicates that the stock is building energy for its next significant move. The linear regression reversal, in this context, could be the catalyst that signals it's ready for the next leg higher.

Given the resilience of cybersecurity stocks, as observed yesterday during a weak market tape, $PANW's current technical setup makes it a compelling name to watch for continued bullish momentum.

Raw Consensus Score: 1 out of 7 (Neutral momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters

Quant volume levels are area where stocks would most likely bounce or reject from.

Today’s Top Idea

NEM Delta Tilt and Gamma Exposure

Newmont Corporation ($NEM) is a key name on our radar today as we observe a developing "risk-off" sentiment in the broader equities market. This shift often sees investors seeking safer assets, and gold, a traditional safe-haven, is firming up in response.

This dynamic creates a potentially favorable environment for gold miners like $NEM. We will be closely watching our quantitative levels to identify potential action points. Technical analysis also indicates that NEM has strong short and long-term trends, with some consolidation and potential pullbacks offering entry opportunities.

Raw Consensus Score: 2 out of 7 (Bullish momentum) (Momentum Stars)

Quant Volume Levels Today 👇

Quant volume clusters for today

Quant volume levels are area where stocks would most likely bounce or reject from.

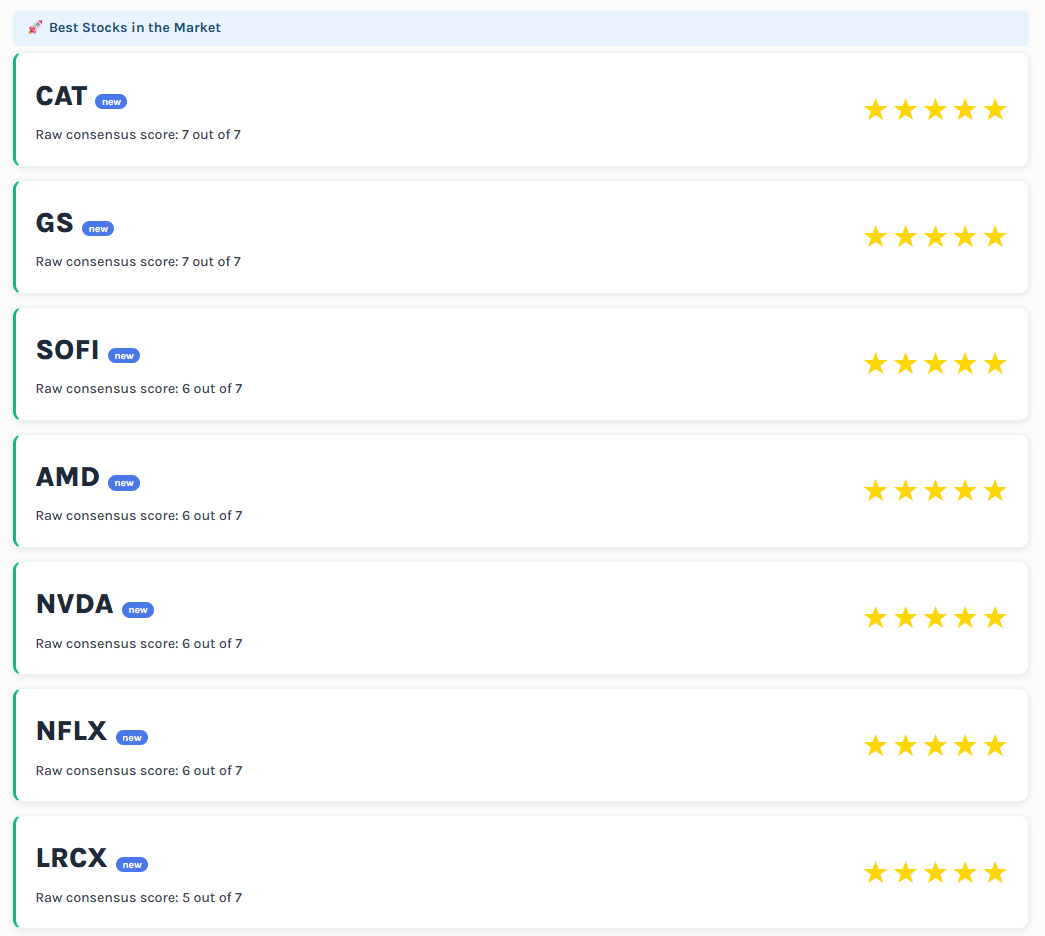

⭐ TODAY’S TOP MOMENTUM STARS

Help us build a better actionable newsletter. Your feedback means a lot to us ❤️